Question: Do not use excel to solve this problem. Only Hand Calculations using Annual worth analysis, present worth analysis, IRR, etc . 4. An investor purchased

Do not use excel to solve this problem. Only Hand Calculations using Annual worth analysis, present worth analysis, IRR, etc .

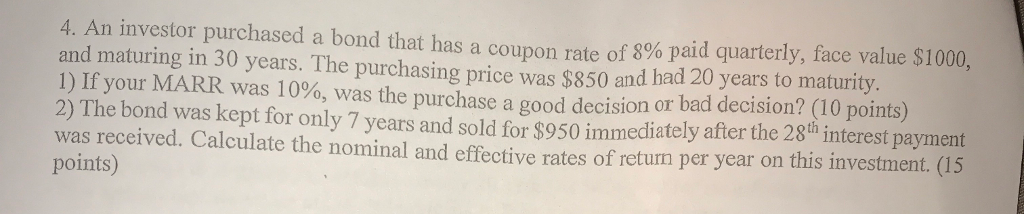

4. An investor purchased a bond that has a coupon rate of 8% paid quarterly, face value $1000, and maturing in 30 years. The purchasing price was $850 and had 20 years to maturity 1) If your MARR was 10%, was the purchase a good decision or bad decision? 10 points) 2) The bond was kept for only 7 years and sold for $950 immediately after the 28th interest payment was received. Calculate the nominal and effective rates of return per year on this investment. (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts