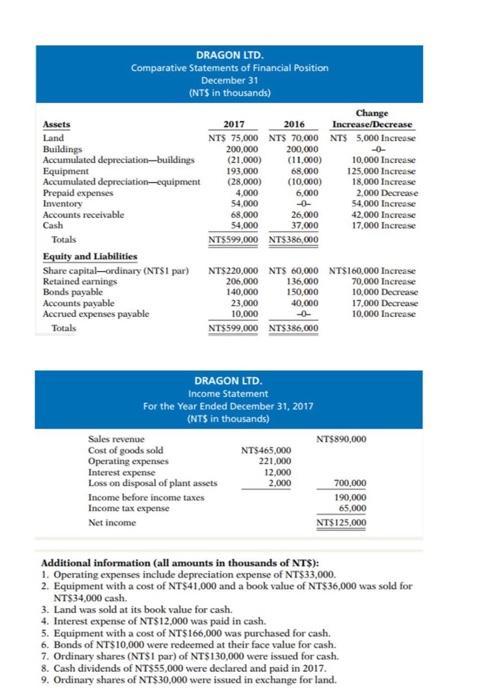

Question: Prepare a statement of cash flow using the indirect and direct method using the information below. Assets Land DRAGON LTD. Comparative Statements of Financial Position

Assets Land DRAGON LTD. Comparative Statements of Financial Position December 31 (NT$ in thousands) Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Prepaid expenses Inventory Accounts receivable Cash Totals Equity and Liabilities Share capital-ordinary (NTS1 par) Retained earnings Bonds payable Accounts payable Accrued expenses payable Totals 2016 NTS 70,000 200,000 (11,000) 68,000 (10,000) 6,000 54,000 + 68,000 26,000 54,000 37,000 NT$599,000 NT$386,000 2017 NT$ 75,000 200,000 (21,000) 193,000 (28,000) 4,000 NT$220,000 NTS 60,000 136,000 206,000 140,000 150,000 23,000 40,000 10,000 + NT$599,000 NT$386,000 DRAGON LTD. Income Statement For the Year Ended December 31, 2017 (NTS in thousands) Sales revenue Cost of goods sold Operating expenses Interest expense Loss on disposal of plant assets Income before income taxes Income tax expense Net income NT$465,000 221,000 12,000 2,000 Change Increase/Decrease NTS 5,000 Increase -0- 10,000 Increase 125,000 Increase 18,000 Increase 2,000 Decrease 54,000 Increase 42,000 Increase 17,000 Increase NT$160,000 Increase 70,000 Increase 10,000 Decrease 17,000 Decrease 10,000 Increase NT$890,000 700,000 190,000 65,000 NT$125,000 Additional information (all amounts in thousands of NTS): 1. Operating expenses include depreciation expense of NT$33,000. 2. Equipment with a cost of NT$41,000 and a book value of NT$36,000 was sold for NT$34,000 cash. 3. Land was sold at its book value for cash. 4. Interest expense of NT$12,000 was paid in cash. 5. Equipment with a cost of NT$166,000 was purchased for cash. 6. Bonds of NT$10,000 were redeemed at their face value for cash. 7. Ordinary shares (NTS1 par) of NT$130,000 were issued for cash. 8. Cash dividends of NT$55,000 were declared and paid in 2017. 9. Ordinary shares of NT$30,000 were issued in exchange for land.

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

DRAGON LTD Statement of Cash Flows For the Year Ended December 31 Cash flow from operating activities Net income Add noncash expenditure Depreciation ... View full answer

Get step-by-step solutions from verified subject matter experts