Question

Eastman Company lost most of its inventory in a fire in December just before the year-end physical inventory was taken. Corporate records disclose the

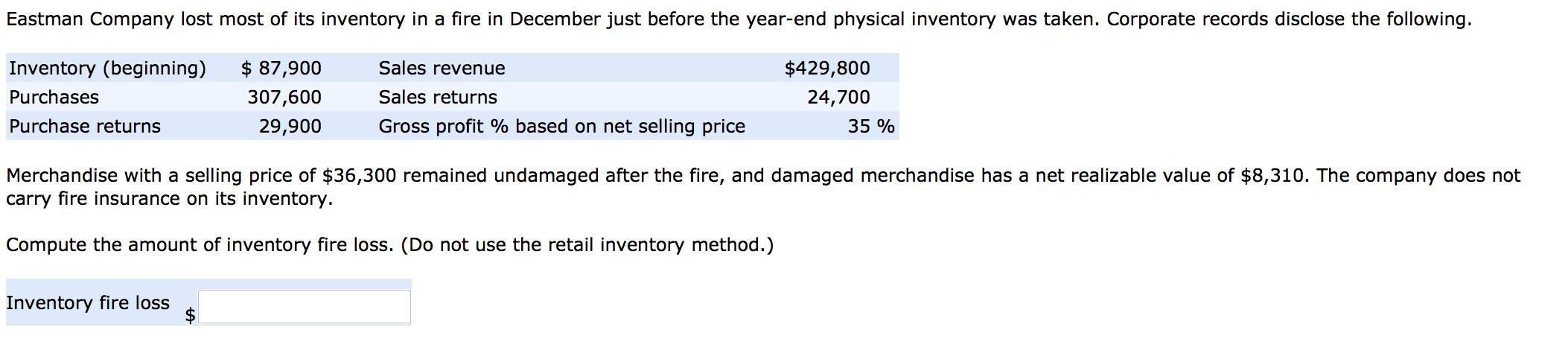

Eastman Company lost most of its inventory in a fire in December just before the year-end physical inventory was taken. Corporate records disclose the following. Inventory (beginning) $ 87,900 Sales revenue $429,800 Purchases 307,600 Sales returns 24,700 Purchase returns 29,900 Gross profit % based on net selling price 35 % Merchandise with a selling price of $36,300 remained undamaged after the fire, and damaged merchandise has a net realizable value of $8,310. The company does not carry fire insurance on its inventory. Compute the amount of inventory fire loss. (Do not use the retail inventory method.) Inventory fire loss

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

A C D E 1 Particulars Amount 2 Purchase 307600 3 Purchase return 29900 4 Beginning inventory ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield

15th edition

978-1118159644, 9781118562185, 1118159640, 1118147294, 978-1118147290

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App