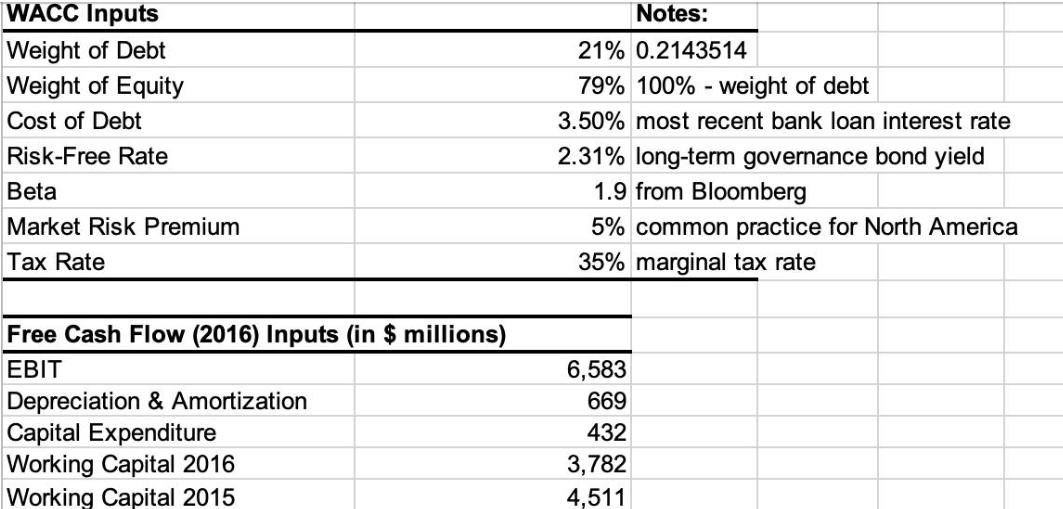

Question: Evaluate Time Warner's value range using the discounted cash flow (DCF) approach WACC Inputs Weight of Debt Weight of Equity Cost of Debt Risk-Free

Evaluate Time Warner's value range using the discounted cash flow (DCF) approach WACC Inputs Weight of Debt Weight of Equity Cost of Debt Risk-Free Rate Beta Market Risk Premium Tax Rate Free Cash Flow (2016) Inputs (in $ millions) EBIT Depreciation & Amortization Capital Expenditure Working Capital 2016 Working Capital 2015 Notes: 21% 0.2143514 - 79% 100% weight of debt 3.50% most recent bank loan interest rate 2.31% long-term governance bond yield 1.9 from Bloomberg 5% common practice for North America 35% marginal tax rate 6,583 669 432 3,782 4,511

Step by Step Solution

There are 3 Steps involved in it

Time Warners Valuation using Discounted Cash Flow DCF Based on the Capital Asset Pricing Model CAPM and the information provided we can estimate the v... View full answer

Get step-by-step solutions from verified subject matter experts