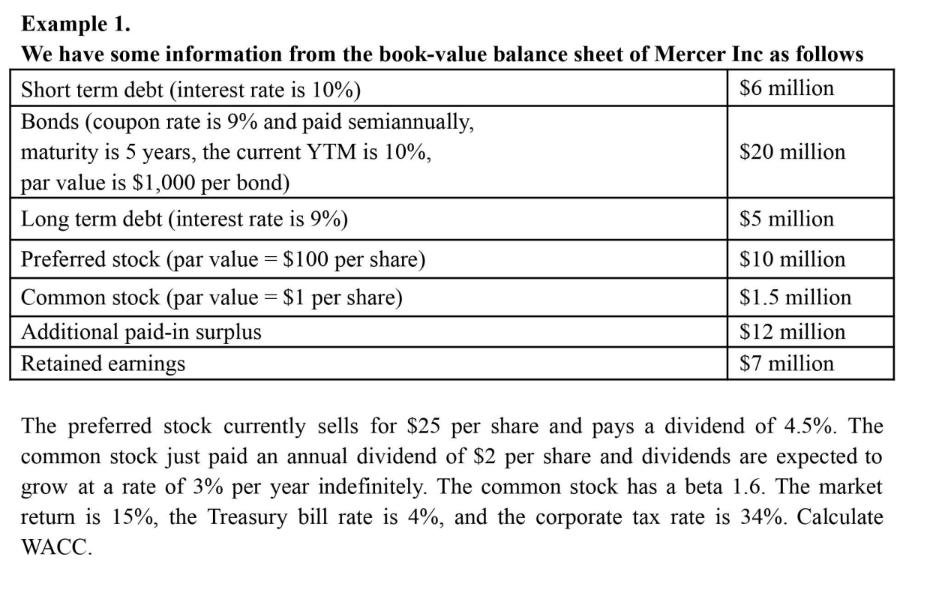

Question: Example 1. We have some information from the book-value balance sheet of Mercer Inc as follows $6 million Short term debt (interest rate is

Example 1. We have some information from the book-value balance sheet of Mercer Inc as follows $6 million Short term debt (interest rate is 10%) Bonds (coupon rate is 9% and paid semiannually, maturity is 5 years, the current YTM is 10%, par value is $1,000 per bond) Long term debt (interest rate is 9%) Preferred stock (par value = $100 per share) Common stock (par value = $1 per share) Additional paid-in surplus Retained earnings $20 million $5 million $10 million $1.5 million $12 million $7 million The preferred stock currently sells for $25 per share and pays a dividend of 4.5%. The common stock just paid an annual dividend of $2 per share and dividends are expected to grow at a rate of 3% per year indefinitely. The common stock has a beta 1.6. The market return is 15%, the Treasury bill rate is 4%, and the corporate tax rate is 34%. Calculate WACC.

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

ANS WER The W ACC is calculated as follows Deb t Weight of debt 6 million 2... View full answer

Get step-by-step solutions from verified subject matter experts