Question: 16 Excel Problem 2 Show All Excel Work (20 points) Brownie Inc is considering a capital project with average risk and needs to calculate the

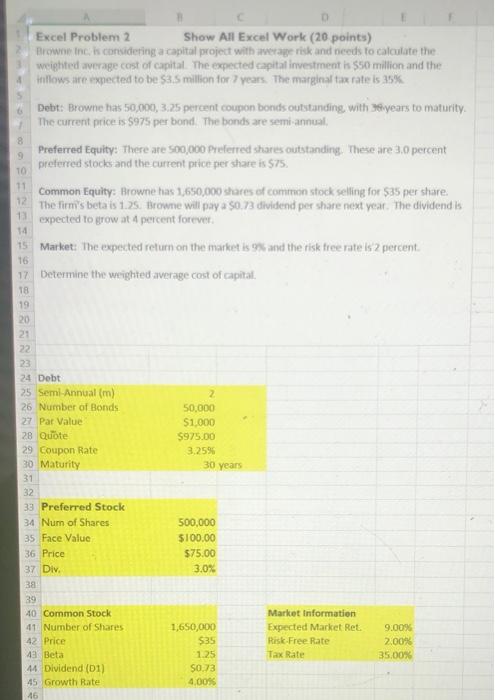

16 Excel Problem 2 Show All Excel Work (20 points) Brownie Inc is considering a capital project with average risk and needs to calculate the weighted average cost of capital. The expected capital investment is 550 million and the tillows are expected to be 53.5 million for 7 years. The marginal tax rate is 15% Debt: Browne has 50,000, 3.25 percent coupon bonds outstanding with years to maturity. The current price is $975 per bond. The bonds are semi-annual 8 Preferred Equity: There are 500,000 Preferred shares outstanding. These are 30 percent preferred stocks and the current ptice per share is $75. TO 10 Common Equity: Browne has 1,650,000 shares of common stock selling for 535 per share, 12 The firm's beta is 1.25. Browne will pay a $0.73 dividend per share next year. The dividend is 1 expected to grow at 4 percent nt forever 15 Market: The expected return on the market is and the risk free rate is 2 percent 17. Determine the weighted average cost of capital. T8 19 20 21 22 23 24 Debt 25 Semi-Annual (m) 2 26 Number of Bonds 50,000 27 Par Value $1,000 28 Quote $975.00 29 Coupon Rate 3.2598 30 Maturity 31 32 33 Preferred Stock 34 Num of Shares 500,000 35 Face Value $100.00 36 Price $75.00 37 Div. 3.0% 3a 39 40 Common Stock Market Information 41 Number of Shares 1,650,000 Expected Market Ret 9.00% 42 Price $35 Risk Free Rate 2.00% 43 Beta 1.25 Tax Rate 35.00% 44. Dividend (D1) $0.73 45 Growth Rate 4.00% 46 30 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts