Question: Exercise 2 (1 mark for each part). We have assumed that the payment dates for the fixed and floating legs of a swap are the

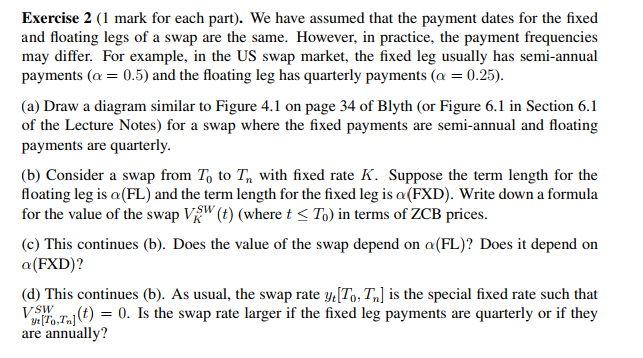

Exercise 2 (1 mark for each part). We have assumed that the payment dates for the fixed and floating legs of a swap are the same. However, in practice, the payment frequencies may differ. For example, in the US swap market, the fixed leg usually has semi-annual payments ( = 0.5) and the floating leg has quarterly payments ( = 0.25) (a) Draw a diagram similar to Figure 4.1 on page 34 of Blyth (or Figure 6.1 in Section 6.1 of the Lecture Notes) for a swap where the fixed payments are semi-annual and floating payments are quarterly (b) Consider a swap from To to Tn with fixed rate K. Suppose the term length for the floating leg is a(FL) and the term length for the fixed leg is a (FXD). Write down a formula for the value of the swap V (t) (where t

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts