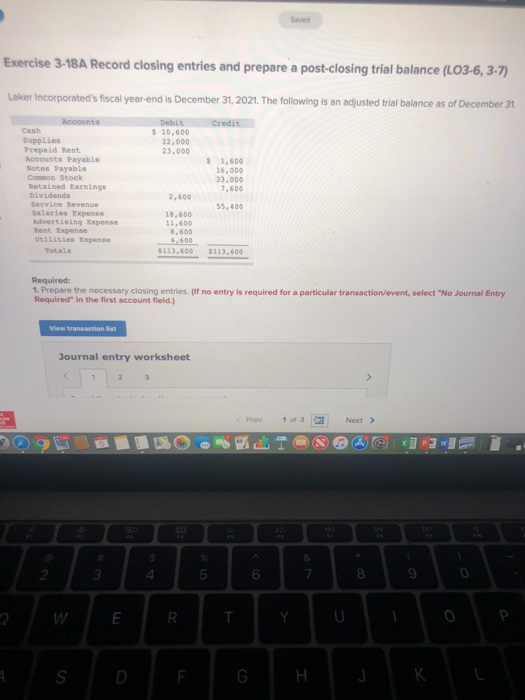

Question: Exercise 3-18A Record closing entries and prepare a post-closing trial balance (L03-6,3-7) Laker Incorporated's fiscal year-end is December 31, 2021. The following is an adjusted

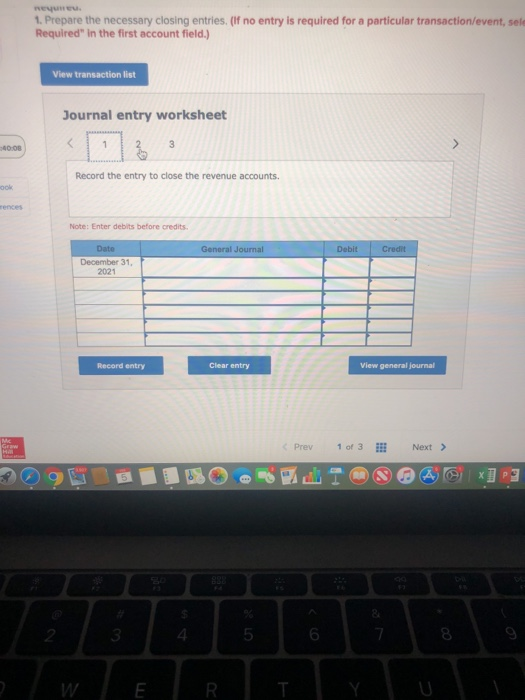

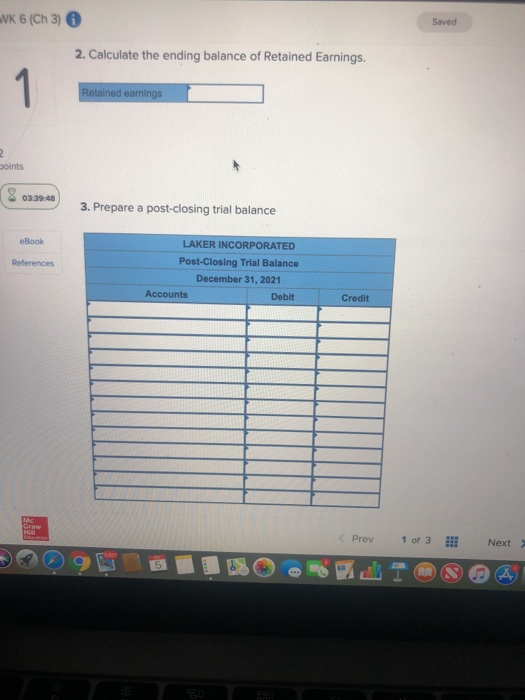

Exercise 3-18A Record closing entries and prepare a post-closing trial balance (L03-6,3-7) Laker Incorporated's fiscal year-end is December 31, 2021. The following is an adjusted trial balance as of December 31 Cash Supplies s 10,600 32,000 23,000 1,600 Prepaid Rent Accounts Payable otes Payable Common Stock Retained Earnings Dividendrs 16,000 33,000 ,600 2,600 Service Revenue Salaries Expense Advertising Expense 55, 400 18,600 11,600 8 600 6600 Rent Expense Utilities Expense Totals 113,600 $113,600 1. Prepare the necessary closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Prev 1 3GE Next > 2 4 5 6 8 0 1. Prepare the necessary closing entries. (If no entry is required for a particular transaction/event, sele Required" in the first account field.) View transaction list Journal entry worksheet Record the entry to close the revenue accounts. ook Note: Enter debits before credits December 31 2021 Record entry Clear entry View general journal Prev1 of 3 Next> 8 2 3 4 5 6 WK 6 (Ch 3) 6 Saved 2. Calculate the ending balance of Retained Earnings. oints 03:3948 3. Prepare a post-closing trial balance eBook LAKER INCORPORATED Post-Closing Trial Balance December 31, 2021 References Debit Credit Prev 1 of 3 Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts