Question: Exercise 4. Suppose that an intermediary faces a certain number of buyers and sellers. The intermediary sets usage prices P, and P, to be paid,

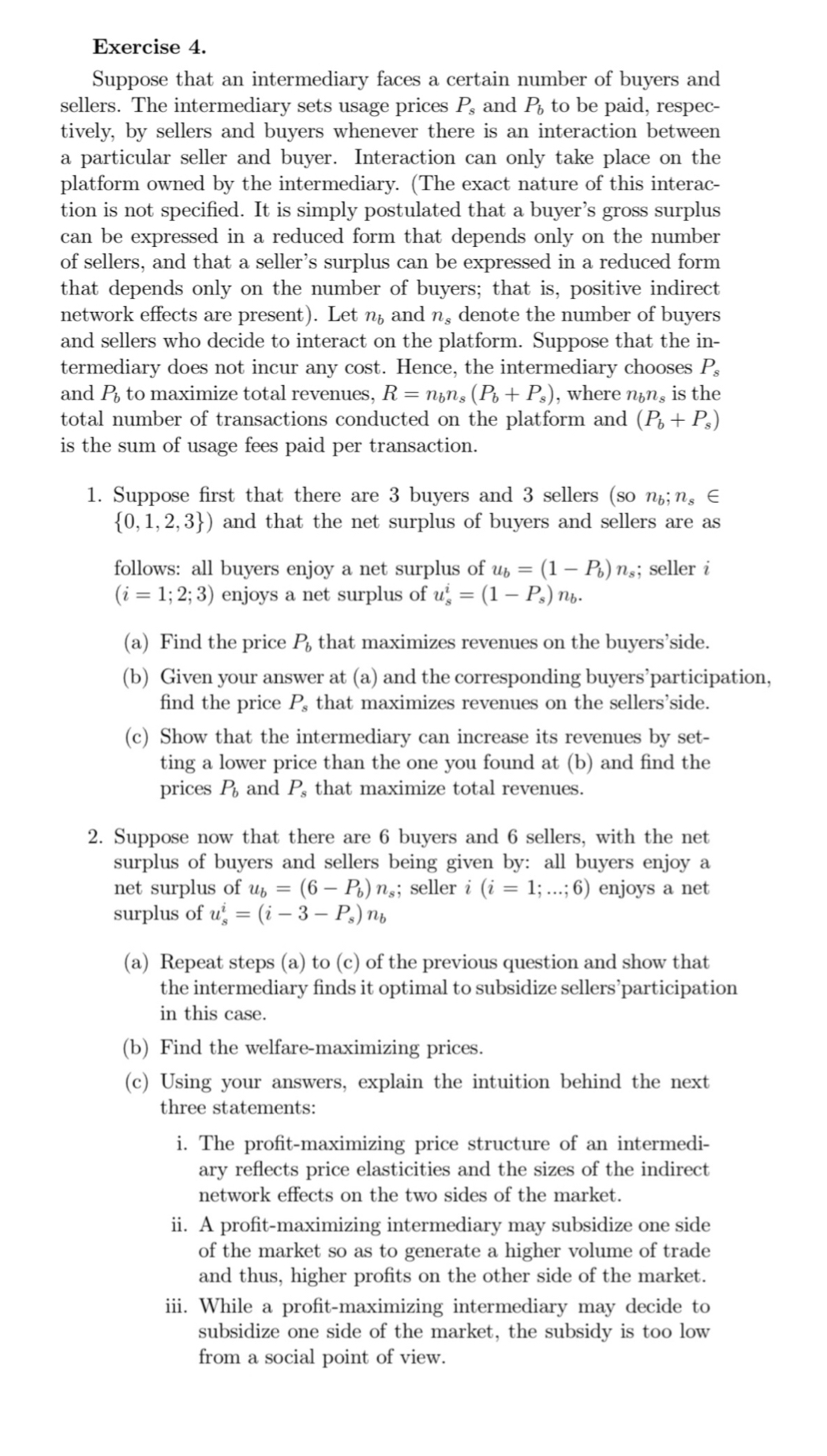

Exercise 4. Suppose that an intermediary faces a certain number of buyers and sellers. The intermediary sets usage prices P, and P, to be paid, respec- tively, by sellers and buyers whenever there is an interaction between a particular seller and buyer. Interaction can only take place on the platform owned by the intermediary. (The exact nature of this interac- tion is not specified. It is simply postulated that a buyer's gross surplus can be expressed in a reduced form that depends only on the number of sellers, and that a seller's surplus can be expressed in a reduced form that depends only on the number of buyers; that is, positive indirect network effects are present). Let n, and n, denote the number of buyers and sellers who decide to interact on the platform. Suppose that the in- termediary does not incur any cost. Hence, the intermediary chooses P, and P, to maximize total revenues, R = nyn, (P, + Ps), where nyn; is the total number of transactions conducted on the platform and (P, + P,) is the sum of usage fees paid per transaction. 1. Suppose first that there are 3 buyers and 3 sellers (so ny:n, {0,1,2,3}) and that the net surplus of buyers and sellers are as follows: all buyers enjoy a net surplus of uy, = (1 B,) n,: seller i (i = 1;2; 3) enjoys a net surplus of v} = (1 P,) n. (a) Find the price P, that maximizes revenues on the buyers'side. (b) Given your answer at (a) and the corresponding buyers'participation, find the price P, that maximizes revenues on the sellers'side. (c) Show that the intermediary can increase its revenues by set- ting a lower price than the one you found at (b) and find the prices P, and P, that maximize total revenues. 2. Suppose now that there are 6 buyers and 6 sellers, with the net surplus of buyers and sellers being given by: all buyers enjoy a net surplus of u, = (6 P,) ng; seller i (i = 1;...;6) enjoys a net surplus of ! = (i 3 P,) n, (a) Repeat steps (a) to (c) of the previous question and show that the intermediary finds it optimal to subsidize sellers'participation in this case. (b) Find the welfare-maximizing prices. (c) Using your answers, explain the intuition behind the next three statements: i. The profit-maximizing price structure of an intermedi- ary reflects price elasticities and the sizes of the indirect network effects on the two sides of the market. ii. A profit-maximizing intermediary may subsidize one side of the market so as to generate a higher volume of trade and thus, higher profits on the other side of the market. iii. While a profit-maximizing intermediary may decide to subsidize one side of the market, the subsidy is too low from a social point of view

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts