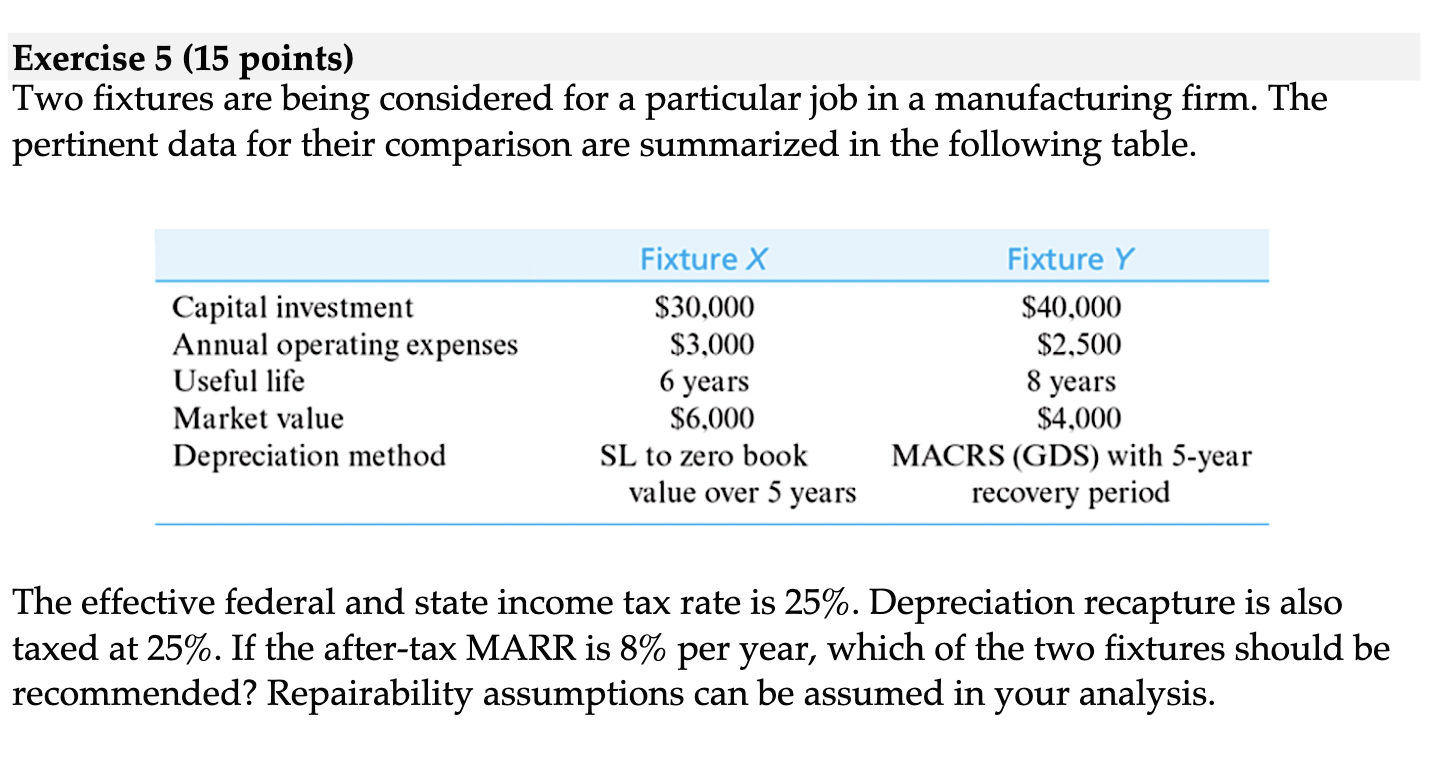

Question: Exercise 5 ( 1 5 points ) Two fixtures are being considered for a particular job in a manufacturing firm. The pertinent data for their

Exercise points Two fixtures are being considered for a particular job in a manufacturing firm. The pertinent data for their comparison are summarized in the following table. begintabularlllhline & Fixture X & Fixture Y hline Capital investment & $ & $hline Annual operating expenses & $ & $hline Useful life & years & years hline Market value & $ & $hline Depreciation method & SL to zero book value over years & MACRS GDS with year recovery period hline endtabular The effective federal and state income tax rate is Depreciation recapture is also taxed at If the aftertax MARR is per year, which of the two fixtures should be recommended? Repairability assumptions can be assumed in your analysis.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock