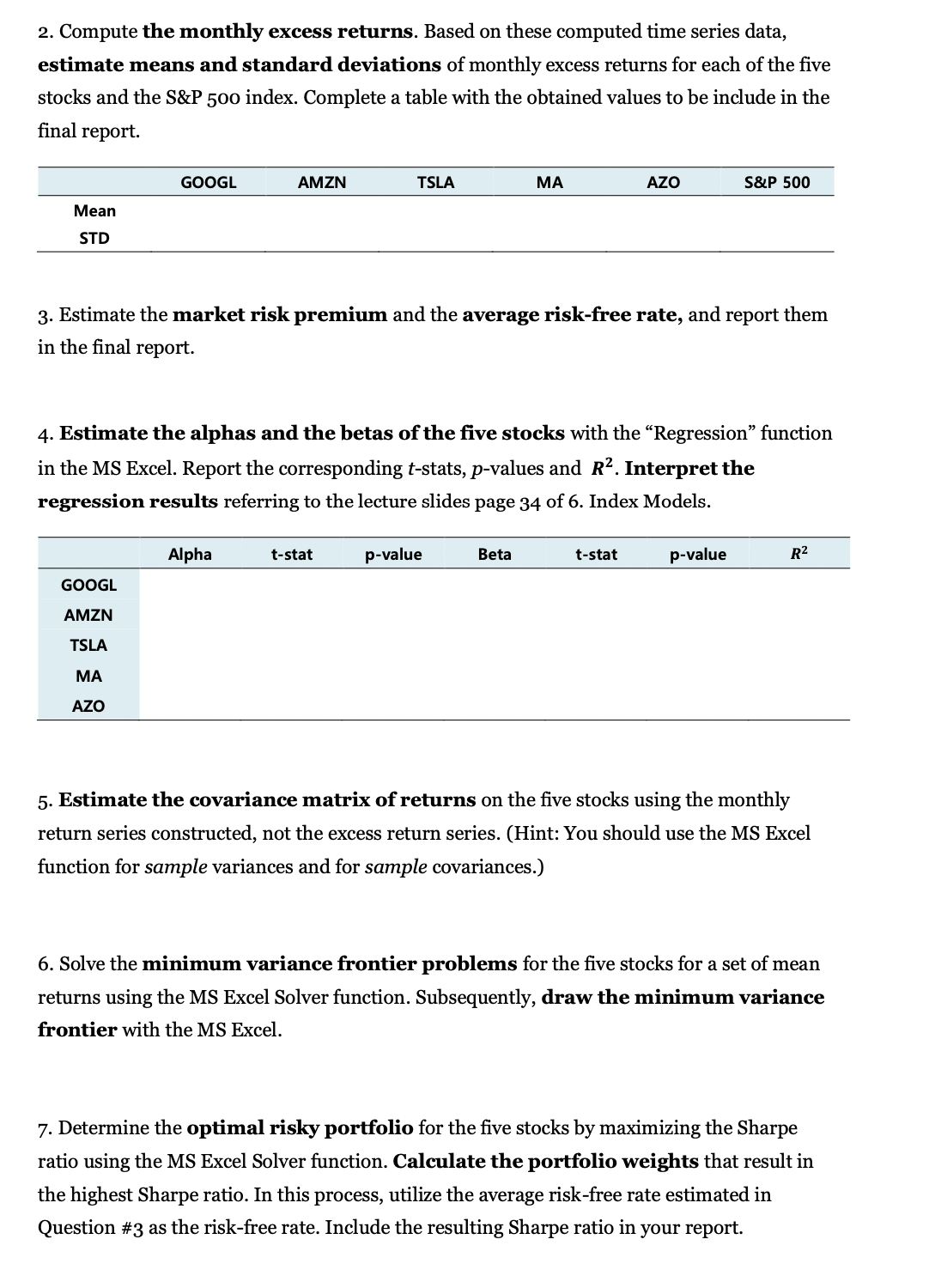

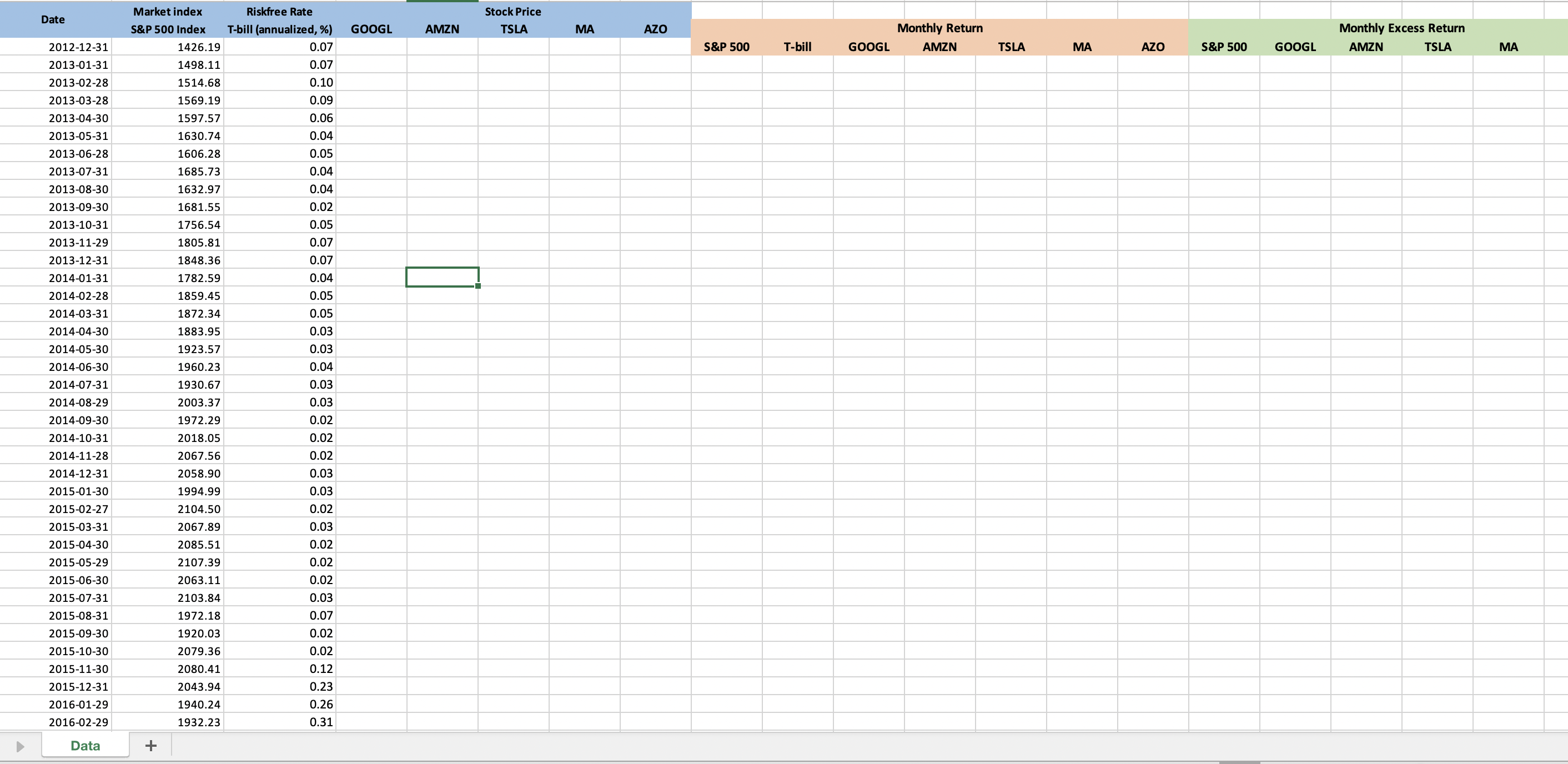

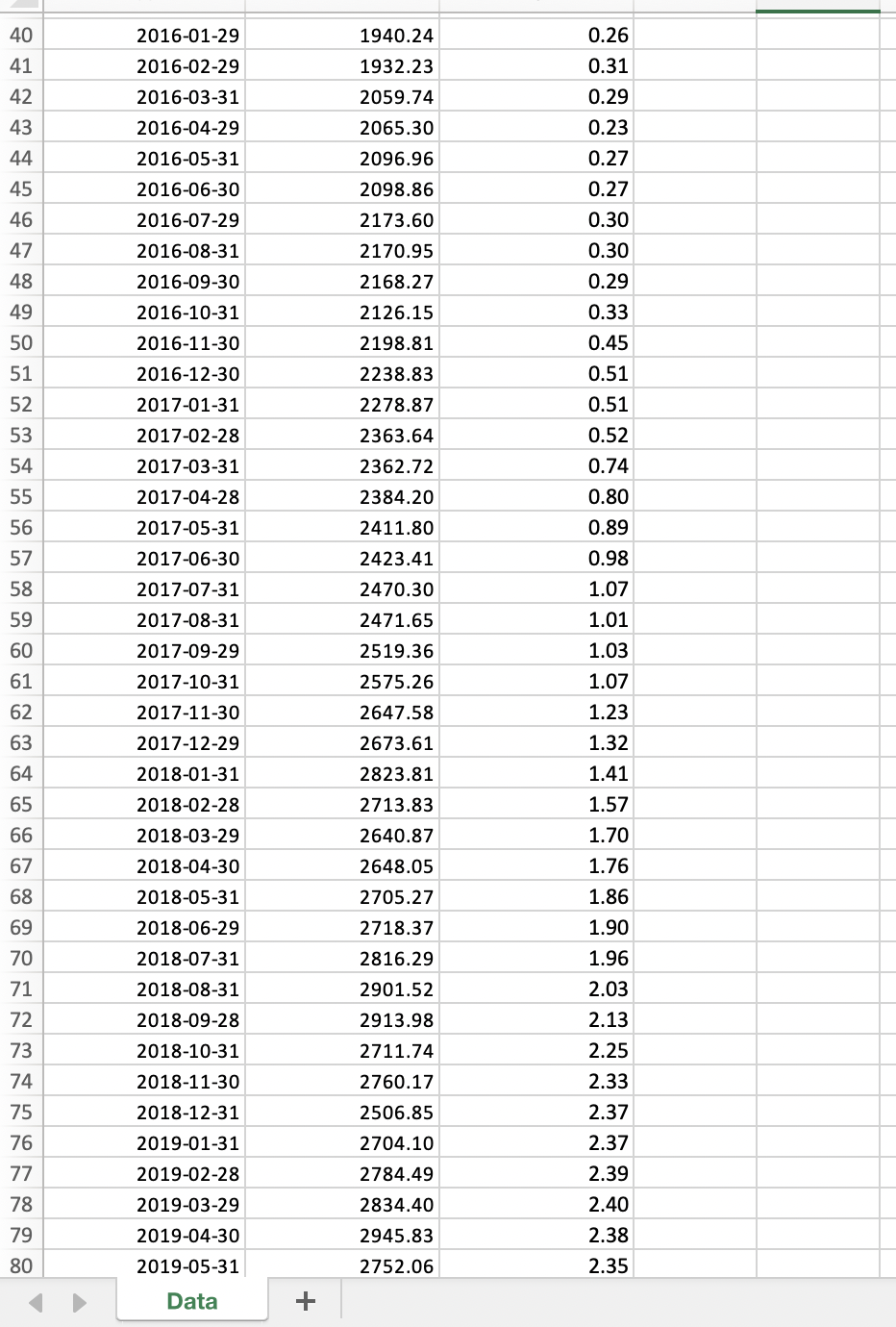

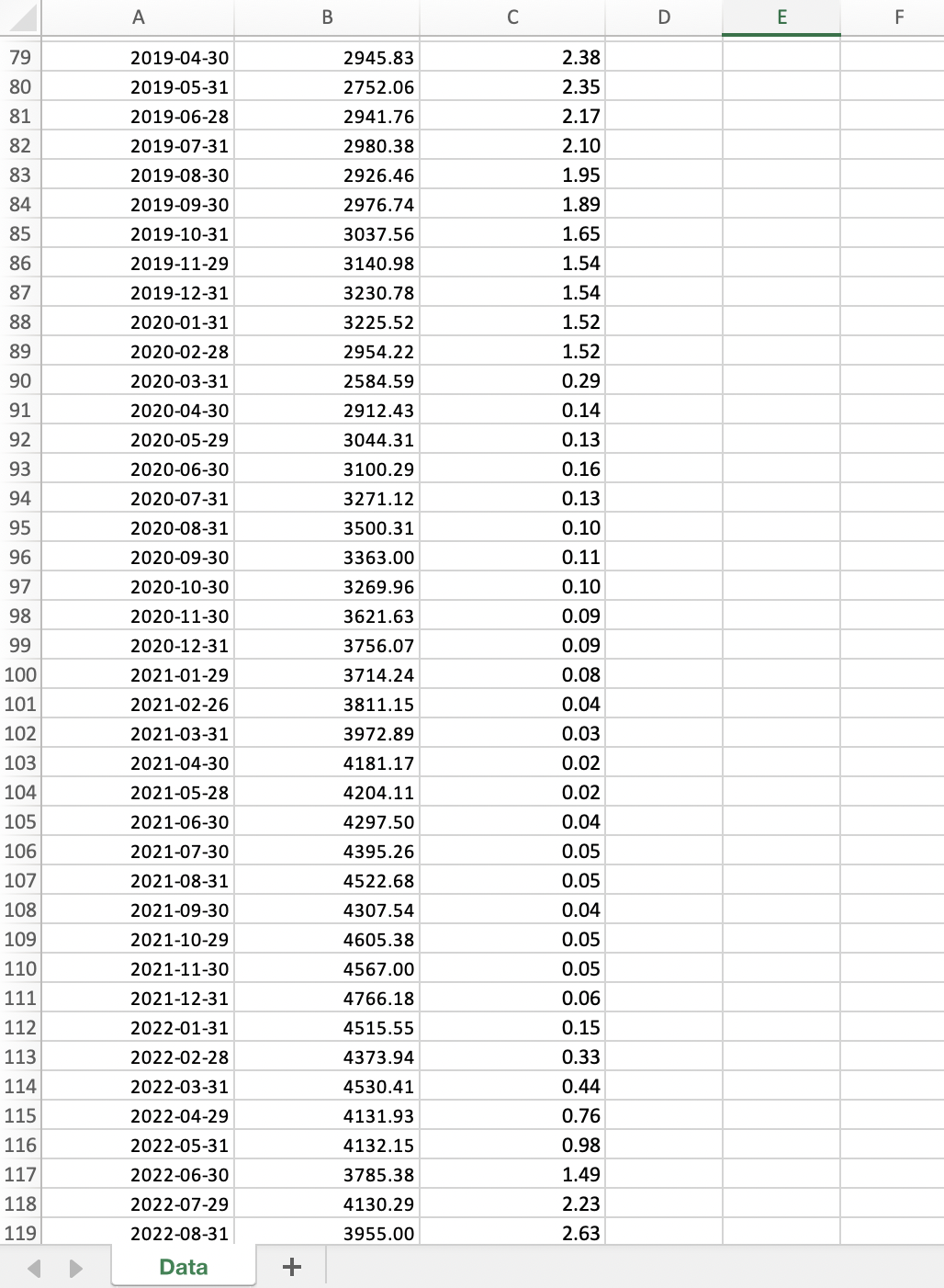

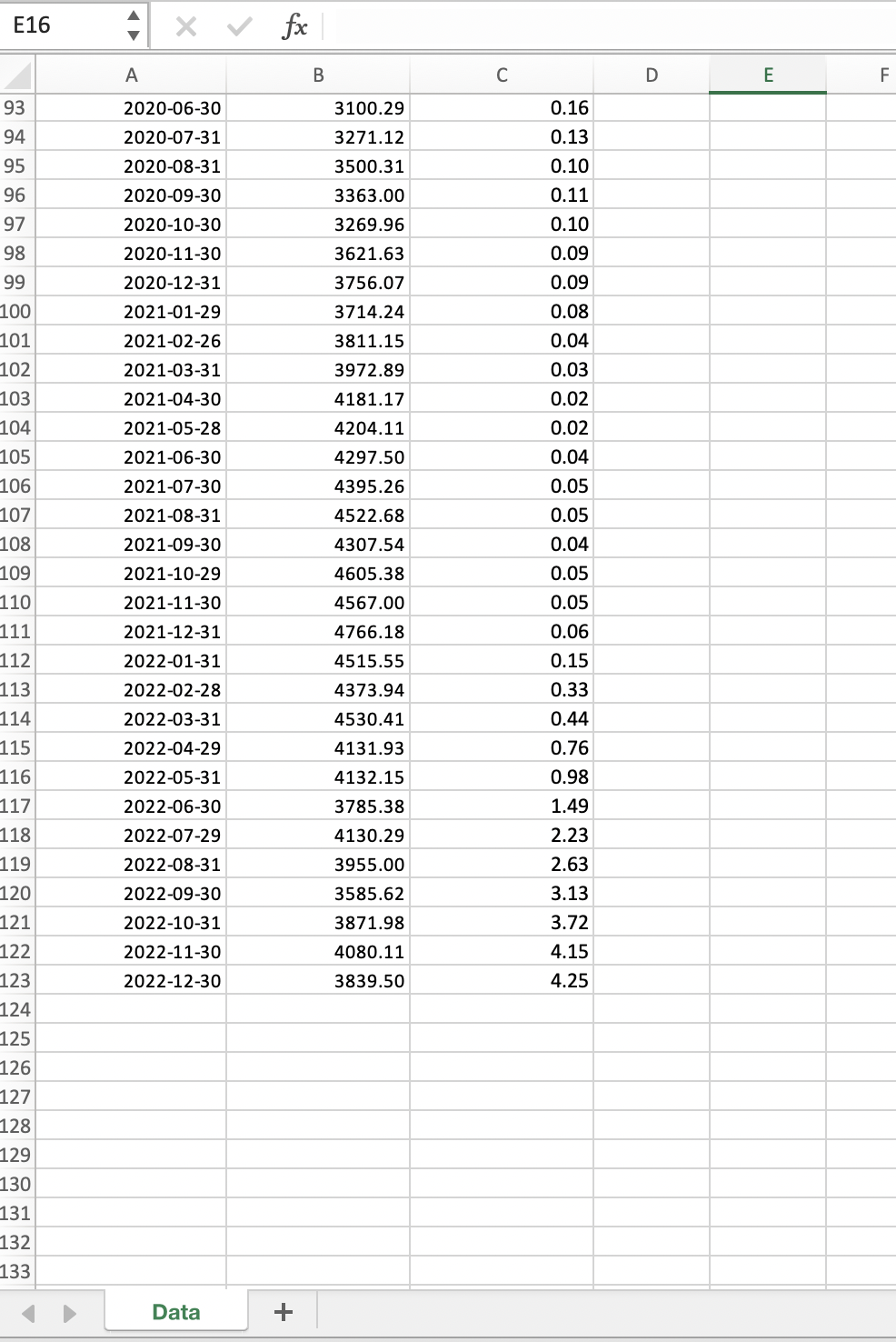

Question: f2. Compute the monthly excess returns. Based on these computed time series data, estimate means and standard deviations of monthly excess returns for each of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts