Question: FAST answer please just need option 46 Ils. : Question 19 3 pts Several questions are associated with the following case study Transponder PLC has

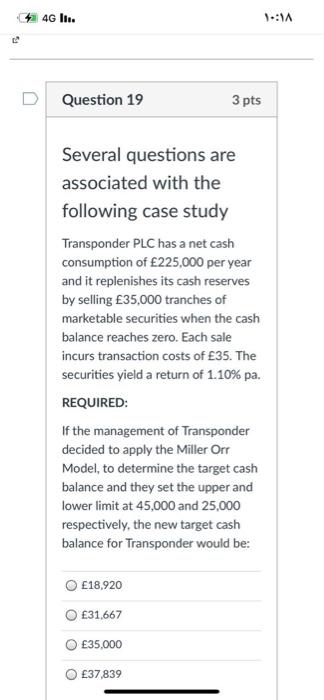

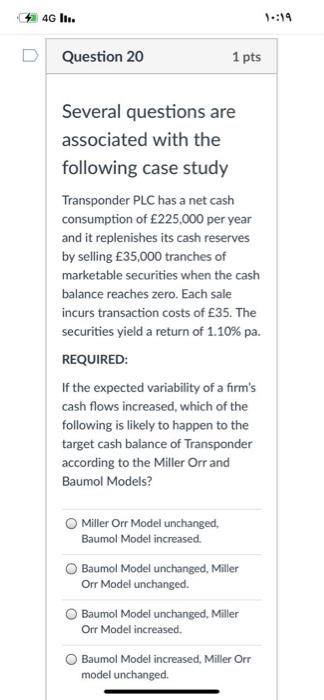

46 Ils. : Question 19 3 pts Several questions are associated with the following case study Transponder PLC has a net cash consumption of 225,000 per year and it replenishes its cash reserves by selling 35,000 tranches of marketable securities when the cash balance reaches zero. Each sale incurs transaction costs of 35. The securities yield a return of 1.10% pa. REQUIRED: If the management of Transponder decided to apply the Miller Orr Model, to determine the target cash balance and they set the upper and lower limit at 45,000 and 25,000 respectively, the new target cash balance for Transponder would be: 18,920 31,667 35,000 37,839 4G lI. : D Question 20 1 pts Several questions are associated with the following case study Transponder PLC has a net cash consumption of 225,000 per year and it replenishes its cash reserves by selling 35,000 tranches of marketable securities when the cash balance reaches zero. Each sale incurs transaction costs of 35. The securities yield a return of 1.10% pa. REQUIRED: If the expected variability of a firm's cash flows increased, which of the following is likely to happen to the target cash balance of Transponder according to the Miller Orr and Baumol Models? Miller Orr Model unchanged, Baumol Model increased Baumol Model unchanged, Miller Orr Model unchanged. Baumol Model unchanged, Miller Orr Model increased Baumol Model increased, Miller Orr model unchanged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts