Question: Fast answer please sur Just need option No need explain I will rate you The problem in a financial institution is that A. incentives of

Fast answer please sur

Just need option

No need explain

I will rate you

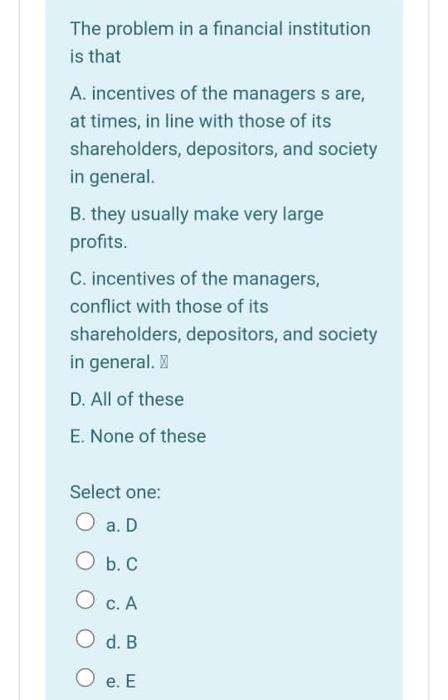

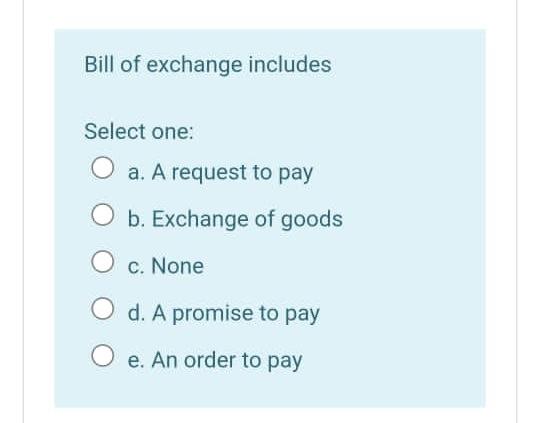

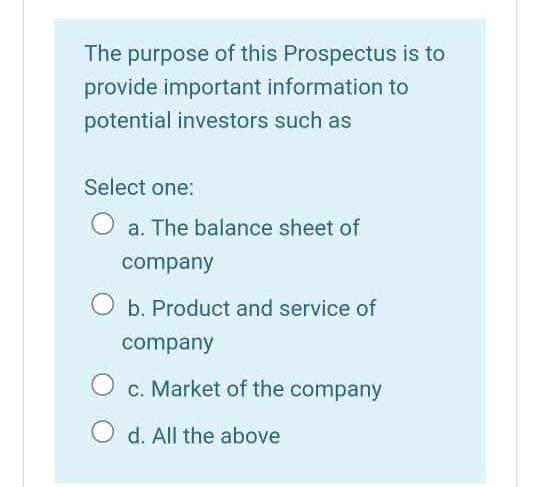

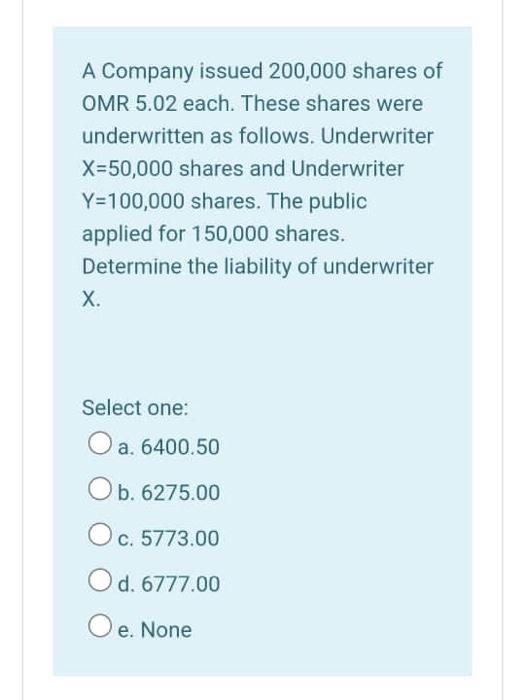

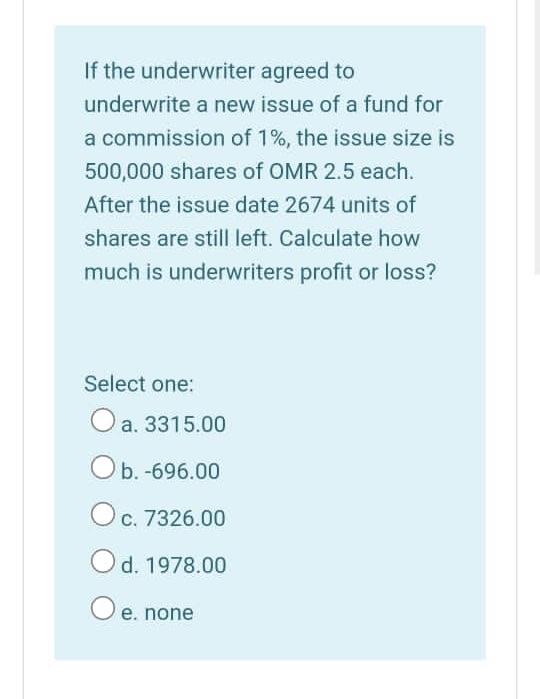

The problem in a financial institution is that A. incentives of the managers s are, at times, in line with those of its shareholders, depositors, and society in general. B. they usually make very large profits. C. incentives of the managers, conflict with those of its shareholders, depositors, and society in general. D. All of these E. None of these Select one: O a. D O b. . O c. A O d. B O e. E Bill of exchange includes Select one: a. A request to pay b. Exchange of goods c. None O d. A promise to pay O e. An order to pay The purpose of this Prospectus is to provide important information to potential investors such as Select one: O a. The balance sheet of a company O b. Product and service of company c. Market of the company d. All the above A Company issued 200,000 shares of OMR 5.02 each. These shares were underwritten as follows. Underwriter X=50,000 shares and Underwriter Y=100,000 shares. The public applied for 150,000 shares. Determine the liability of underwriter X. Select one: O a. 6400.50 Ob. 6275.00 O c. 5773.00 O d. 6777.00 Oe. None If the underwriter agreed to underwrite a new issue of a fund for a commission of 1%, the issue size is 500,000 shares of OMR 2.5 each. After the issue date 2674 units of shares are still left. Calculate how much is underwriters profit or loss? Select one: O a. 3315.00 O. -696.00 O c. 7326.00 O d. 1978.00 Oe. none

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts