Question: Fast answer please sur Just need option No need explain I will rate you Suppose you work as a broker in an investment company, and

Fast answer please sur

Just need option

No need explain

I will rate you

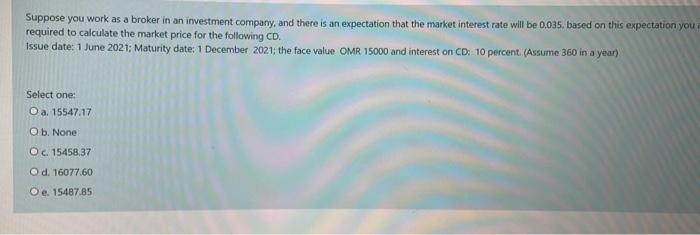

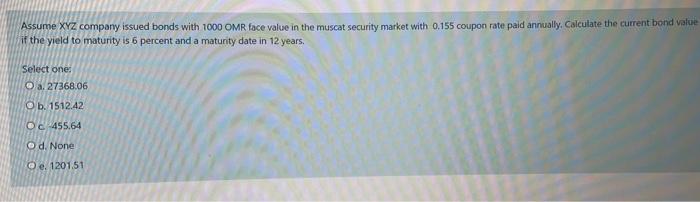

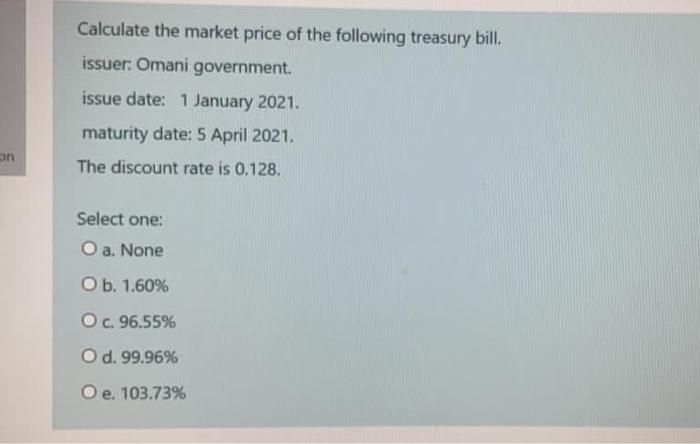

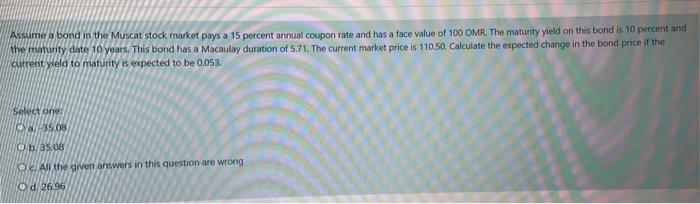

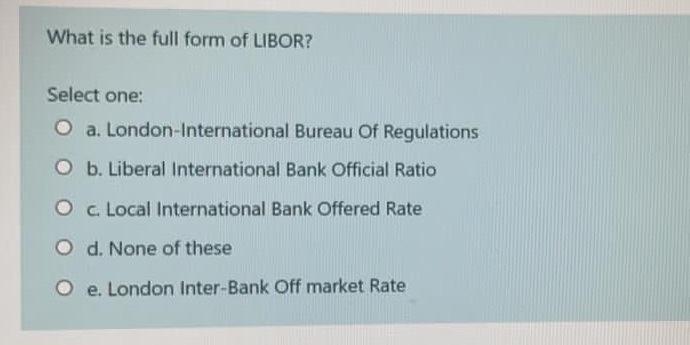

Suppose you work as a broker in an investment company, and there is an expectation that the market interest rate will be 0.035, based on this expectation you a Issue date: 1 June 2021; Maturity date: 1 December 2021; the face value OMR 15000 and interest on CD: 10 percent. (Assume 360 in a year) required to calculate the market price for the following CD. Select one: O a. 15547.17 O b. None O c. 15458,37 O d. 16077.60 O e. 15487.85 Assume XYZ company issued bonds with 1000 OMR face value in the muscat security market with 0.155 coupon rate paid annually. Calculate the current bond value if the yield to maturity is 6 percent and a maturity date in 12 years. Select ones O a. 27368.06 O b. 1512.42 Oc455.64 O d. None e. 1201.51 Calculate the market price of the following treasury bill. issuer: Omani government. issue date: 1 January 2021. maturity date: 5 April 2021. an The discount rate is 0.128. Select one: O a. None O b. 1.60% O c. 96.55% O d. 99.96% O e. 103.73% Assume a bond in the Muscat stock market pays a 15 percent anrwal coupon rate and has a face value of 100 OMR. The maturity yield on this bond is 10 percent and the maturity date 10 years. This bond has a Macaulay duration of 5.71. The current market price is 110.50. Calculate the expected change in the bond price if the current yield to maturity is expected to be 0.053 Select one 098/35.OB Ob 85.08 O All the given answers in this question are wrong Od 26.96 What is the full form of LIBOR? Select one: O a. London-International Bureau Of Regulations O b. Liberal International Bank Official Ratio O c Local International Bank Offered Rate O d. None of these O e. London Inter-Bank Off market Rate Suppose you work as a broker in an investment company, and there is an expectation that the market interest rate will be 0.035, based on this expectation you a Issue date: 1 June 2021; Maturity date: 1 December 2021; the face value OMR 15000 and interest on CD: 10 percent. (Assume 360 in a year) required to calculate the market price for the following CD. Select one: O a. 15547.17 O b. None O c. 15458,37 O d. 16077.60 O e. 15487.85 Assume XYZ company issued bonds with 1000 OMR face value in the muscat security market with 0.155 coupon rate paid annually. Calculate the current bond value if the yield to maturity is 6 percent and a maturity date in 12 years. Select ones O a. 27368.06 O b. 1512.42 Oc455.64 O d. None e. 1201.51 Calculate the market price of the following treasury bill. issuer: Omani government. issue date: 1 January 2021. maturity date: 5 April 2021. an The discount rate is 0.128. Select one: O a. None O b. 1.60% O c. 96.55% O d. 99.96% O e. 103.73% Assume a bond in the Muscat stock market pays a 15 percent anrwal coupon rate and has a face value of 100 OMR. The maturity yield on this bond is 10 percent and the maturity date 10 years. This bond has a Macaulay duration of 5.71. The current market price is 110.50. Calculate the expected change in the bond price if the current yield to maturity is expected to be 0.053 Select one 098/35.OB Ob 85.08 O All the given answers in this question are wrong Od 26.96 What is the full form of LIBOR? Select one: O a. London-International Bureau Of Regulations O b. Liberal International Bank Official Ratio O c Local International Bank Offered Rate O d. None of these O e. London Inter-Bank Off market Rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts