Question: FIN3000, Chapter 8 Risk and Rates of Return Problem Solving 1. Dana Industries has a beta of 1 and required rate of return is 10.20%.

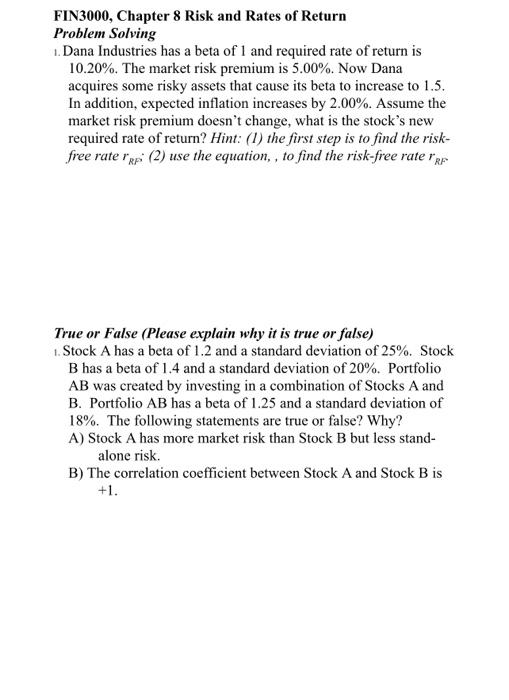

FIN3000, Chapter 8 Risk and Rates of Return Problem Solving 1. Dana Industries has a beta of 1 and required rate of return is 10.20%. The market risk premium is 5.00%. Now Dana acquires some risky assets that cause its beta to increase to 1.5 . In addition, expected inflation increases by 2.00%. Assume the market risk premium doesn't change, what is the stock's new required rate of return? Hint: (1) the first step is to find the riskfree rate rRF (2) use the equation, , to find the risk-free rate rRF True or False (Please explain why it is true or false) 1. Stock A has a beta of 1.2 and a standard deviation of 25%. Stock B has a beta of 1.4 and a standard deviation of 20%. Portfolio AB was created by investing in a combination of Stocks A and B. Portfolio AB has a beta of 1.25 and a standard deviation of 18%. The following statements are true or false? Why? A) Stock A has more market risk than Stock B but less standalone risk. B) The correlation coefficient between Stock A and Stock B is +1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts