Question: Financial Math Problem: Black-Scholes formula Problem 4 (Required, 25 marks) The current price of an asset is $100 and its price process satisfies dSt =

Financial Math Problem: Black-Scholes formula

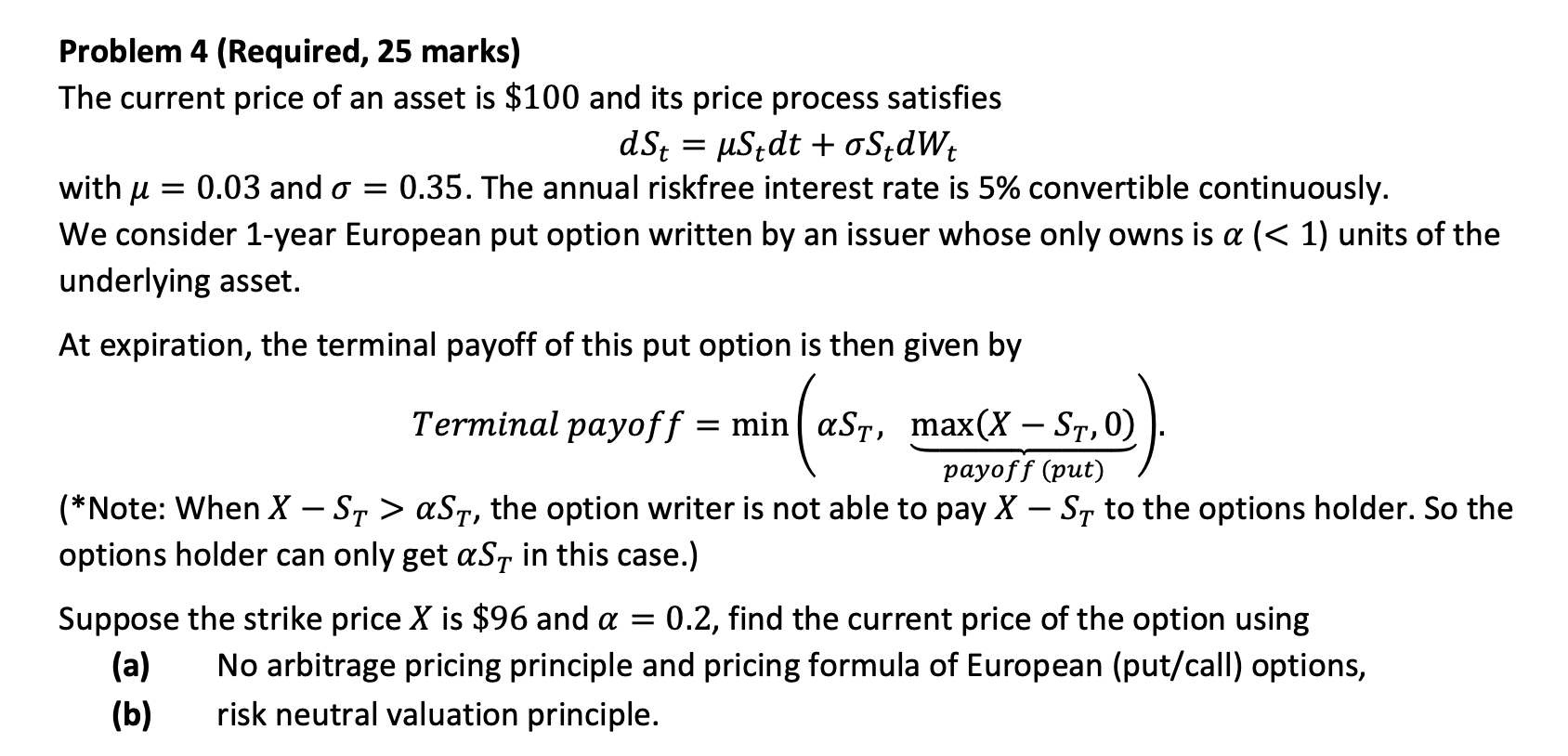

Problem 4 (Required, 25 marks) The current price of an asset is $100 and its price process satisfies dSt = uStdt + StdWt with u = 0.03 and o = 0.35. The annual riskfree interest rate is 5% convertible continuously. We consider 1-year European put option written by an issuer whose only owns is a ( ast, the option writer is not able to pay X Sy to the options holder. So the options holder can only get as in this case.) Suppose the strike price X is $96 and a = 0.2, find the current price of the option using (a) No arbitrage pricing principle and pricing formula of European (put/call) options, (b) risk neutral valuation principle. Problem 4 (Required, 25 marks) The current price of an asset is $100 and its price process satisfies dSt = uStdt + StdWt with u = 0.03 and o = 0.35. The annual riskfree interest rate is 5% convertible continuously. We consider 1-year European put option written by an issuer whose only owns is a ( ast, the option writer is not able to pay X Sy to the options holder. So the options holder can only get as in this case.) Suppose the strike price X is $96 and a = 0.2, find the current price of the option using (a) No arbitrage pricing principle and pricing formula of European (put/call) options, (b) risk neutral valuation principle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts