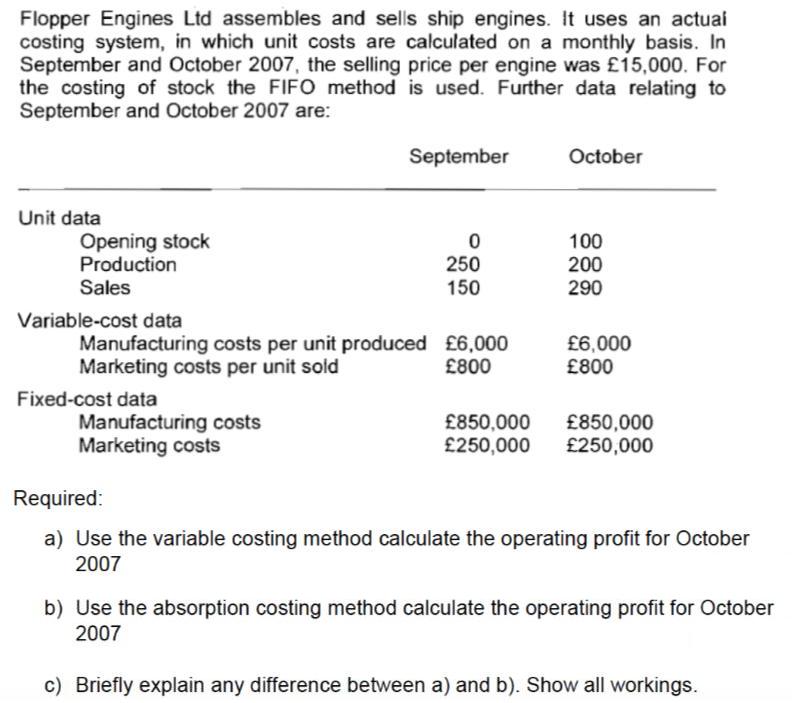

Question: Flopper Engines Ltd assembles and sells ship engines. It uses an actuai costing system, in which unit costs are calculated on a monthly basis.

Flopper Engines Ltd assembles and sells ship engines. It uses an actuai costing system, in which unit costs are calculated on a monthly basis. In September and October 2007, the selling price per engine was 15,000. For the costing of stock the FIFO method is used. Further data relating to September and October 2007 are: September October Unit data Opening stock Production Sales 100 200 250 150 290 Variable-cost data Manufacturing costs per unit produced 6,000 Marketing costs per unit sold 6,000 800 800 Fixed-cost data Manufacturing costs Marketing costs 850,000 250,000 850,000 250,000 Required: a) Use the variable costing method calculate the operating profit for October 2007 b) Use the absorption costing method calculate the operating profit for October 2007 c) Briefly explain any difference between a) and b). Show all workings.

Step by Step Solution

3.29 Rating (167 Votes )

There are 3 Steps involved in it

a Income statement FLOPPER ENGINES Ltd VARIABLE COSTING INCOME STATEMENT Sales 4350000 Less variable cost of goods sold Opening inventory 600000 Add variable cost of goods manufactured 1200000 Variabl... View full answer

Get step-by-step solutions from verified subject matter experts