Question: For cash flows shown in the table below, draw a cash flow diagram. (100 points) Label all cash flows on the diagram. Indicate the type

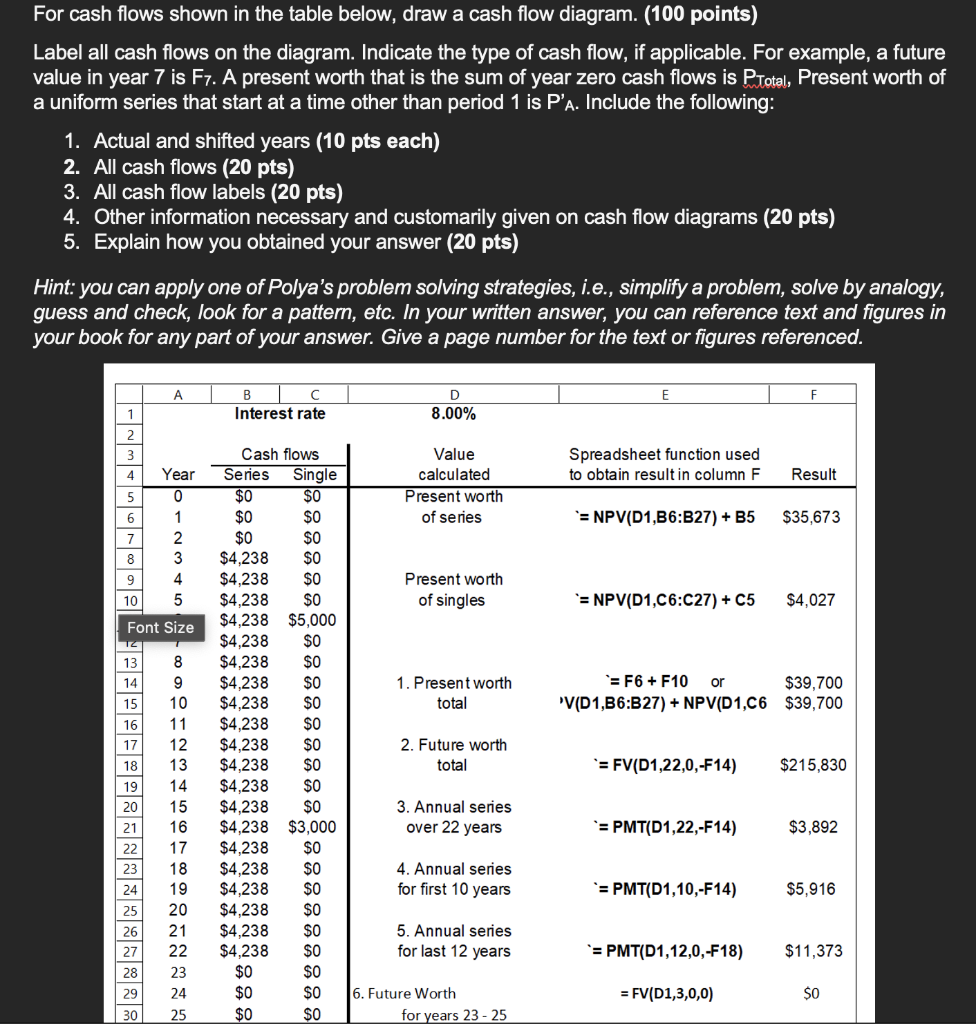

For cash flows shown in the table below, draw a cash flow diagram. (100 points) Label all cash flows on the diagram. Indicate the type of cash flow, if applicable. For example, a future value in year 7 is F7. A present worth that is the sum of year zero cash flows is PTotal, Present worth of a uniform series that start at a time other than period 1 is P'a. Include the following: 1. Actual and shifted years (10 pts each) 2. All cash flows (20 pts) 3. All cash flow labels (20 pts) 4. Other information necessary and customarily given on cash flow diagrams (20 pts) 5. Explain how you obtained your answer (20 pts) Hint: you can apply one of Polya's problem solving strategies, i.e., simplify a problem, solve by analogy, guess and check, look for a pattern, etc. In your written answer, you can reference text and figures in your book for any part of your answer. Give a page number for the text or figures referenced. B Interest rate D 8.00% 1 2 3 Spreadsheet function used to obtain result in column F 4 Result Value calculated Present worth of series 5 6 Year 0 1 2 3 4 '= NPV(D1,B6:B27) + B5 $35,673 7 8 9 10 Present worth of singles 5 = NPV(D1,C6:C27) + C5 $4,027 1. Present worth total '=F6 + F10 or $39,700 'V(D1,B6:B27) + NPV(D1,C6 $39,700 Font Size 12 13 8 14 9 15 10 16 11 17 12 18 13 19 14 20 15 21 16 Cash flows Series Single $0 $0 $0 $0 $0 $0 $4,238 $0 $4,238 $0 $4,238 $0 $4,238 $5,000 $4,238 $0 $4,238 $0 $4,238 $0 $4,238 $0 $4,238 $0 $4,238 SO $4,238 $0 $4.238 $0 $4,238 $0 $4,238 $3,000 $4,238 $0 $4,238 $0 $4,238 $0 $4,238 $0 $4,238 $0 $4,238 $0 $0 $0 $0 $0 $0 SO 2. Future worth total '= FV(D1,22,0,-F14) $215,830 3. Annual series over 22 years '= PMT(D1,22,-F14) $3,892 890HQ84BBB983%Bu 22 23 4. Annual series for first 10 years 24 '= PMT(D1,10,-F14) $5,916 25 26 18 19 20 21 22 23 24 25 5. Annual series for last 12 years 27 '= PMT(D1,12,0,-F18) $11,373 28 29 = FV(D1,3,0,0) $0 6. Future Worth for years 23 - 25 30 For cash flows shown in the table below, draw a cash flow diagram. (100 points) Label all cash flows on the diagram. Indicate the type of cash flow, if applicable. For example, a future value in year 7 is F7. A present worth that is the sum of year zero cash flows is PTotal, Present worth of a uniform series that start at a time other than period 1 is P'a. Include the following: 1. Actual and shifted years (10 pts each) 2. All cash flows (20 pts) 3. All cash flow labels (20 pts) 4. Other information necessary and customarily given on cash flow diagrams (20 pts) 5. Explain how you obtained your answer (20 pts) Hint: you can apply one of Polya's problem solving strategies, i.e., simplify a problem, solve by analogy, guess and check, look for a pattern, etc. In your written answer, you can reference text and figures in your book for any part of your answer. Give a page number for the text or figures referenced. B Interest rate D 8.00% 1 2 3 Spreadsheet function used to obtain result in column F 4 Result Value calculated Present worth of series 5 6 Year 0 1 2 3 4 '= NPV(D1,B6:B27) + B5 $35,673 7 8 9 10 Present worth of singles 5 = NPV(D1,C6:C27) + C5 $4,027 1. Present worth total '=F6 + F10 or $39,700 'V(D1,B6:B27) + NPV(D1,C6 $39,700 Font Size 12 13 8 14 9 15 10 16 11 17 12 18 13 19 14 20 15 21 16 Cash flows Series Single $0 $0 $0 $0 $0 $0 $4,238 $0 $4,238 $0 $4,238 $0 $4,238 $5,000 $4,238 $0 $4,238 $0 $4,238 $0 $4,238 $0 $4,238 $0 $4,238 SO $4,238 $0 $4.238 $0 $4,238 $0 $4,238 $3,000 $4,238 $0 $4,238 $0 $4,238 $0 $4,238 $0 $4,238 $0 $4,238 $0 $0 $0 $0 $0 $0 SO 2. Future worth total '= FV(D1,22,0,-F14) $215,830 3. Annual series over 22 years '= PMT(D1,22,-F14) $3,892 890HQ84BBB983%Bu 22 23 4. Annual series for first 10 years 24 '= PMT(D1,10,-F14) $5,916 25 26 18 19 20 21 22 23 24 25 5. Annual series for last 12 years 27 '= PMT(D1,12,0,-F18) $11,373 28 29 = FV(D1,3,0,0) $0 6. Future Worth for years 23 - 25 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts