Question: From the data below for Apple (AAPL) stock, calculate the upper and lower Bollinger bands, which represent plus (or minus) two standard deviations of the

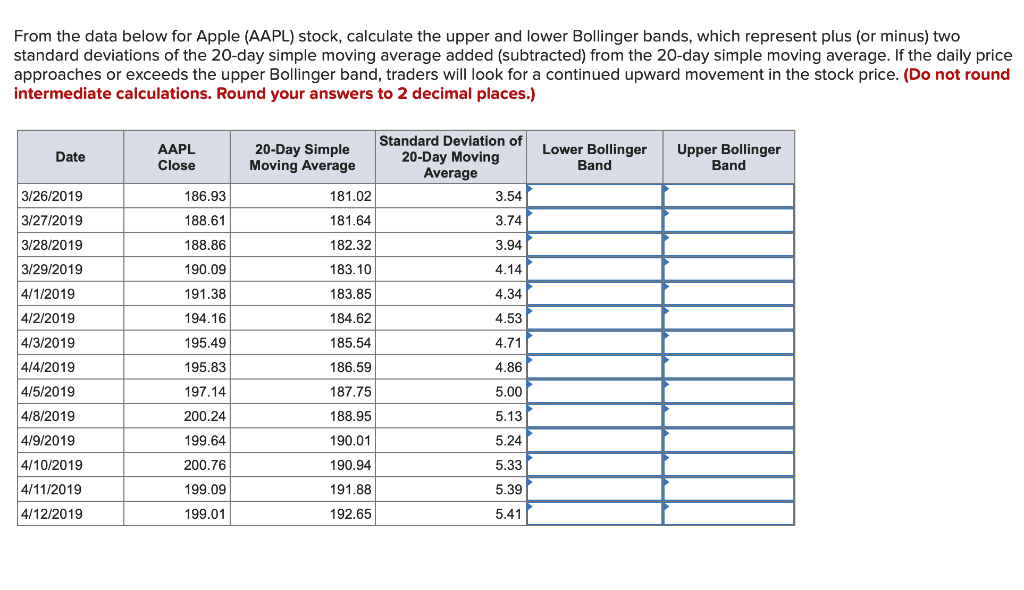

From the data below for Apple (AAPL) stock, calculate the upper and lower Bollinger bands, which represent plus (or minus) two standard deviations of the 20-day simple moving average added (subtracted) from the 20-day simple moving average. If the daily price approaches or exceeds the upper Bollinger band, traders will look for a continued upward movement in the stock price. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

From the data below for Apple (AAPL) stock, calculate the upper and lower Bollinger bands, which represent plus (or minus) two standard deviations of the 20-day simple moving average added (subtracted) from the 20-day simple moving average. If the daily price approaches or exceeds the upper Bollinger band, traders will look for a continued upward movement in the stock price. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Date AAPL Close 20-Day Simple Moving Average Standard Deviation of 20-Day Moving Average 3.54 Lower Bollinger Band Upper Bollinger Band 3/26/2019 186.93 181.02 3/27/2019 188.61 181.64 3.74 3/28/2019 188.86 182.32 3.94 3/29/2019 190.09 183.10 4.14 4/1/2019 183.85 4.34 191.38 194.16 4/2/2019 184.62 4.53 4/3/2019 195.49 185.54 4.71 4/4/2019 186.59 4.86 4/5/2019 187.75 4/8/2019 4/9/2019 195.83 197.14 200.24 199.64 200.76 199.09 188.95 190.01 190.94 5.00 5.13 5.24 5.33 5.39 4/10/2019 4/11/2019 191.88 4/12/2019 199.01 192.65 5.41

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts