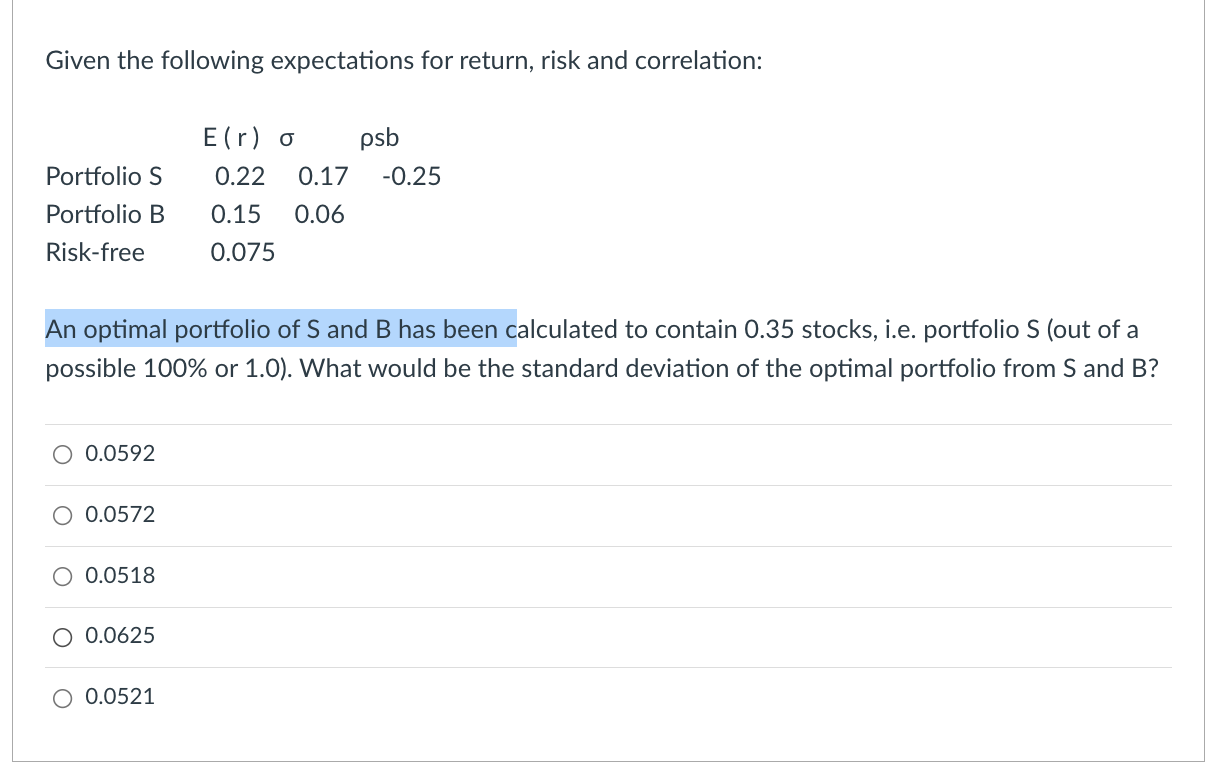

Question: Given the following expectations for return, risk and correlation: E(r) o psb Portfolios 0.22 0.17 -0.25 Portfolio B 0.15 0.06 Risk-free 0.075 An optimal portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts