Question: Google Chrome isn't your default browser Set as default Annual Federal Tax Refresher Course EXAM CPE D CHANGE COURSE DASHBOARD YOU HAVE A MAXIMUM OF

Google Chrome isn't your default browser

Set as default

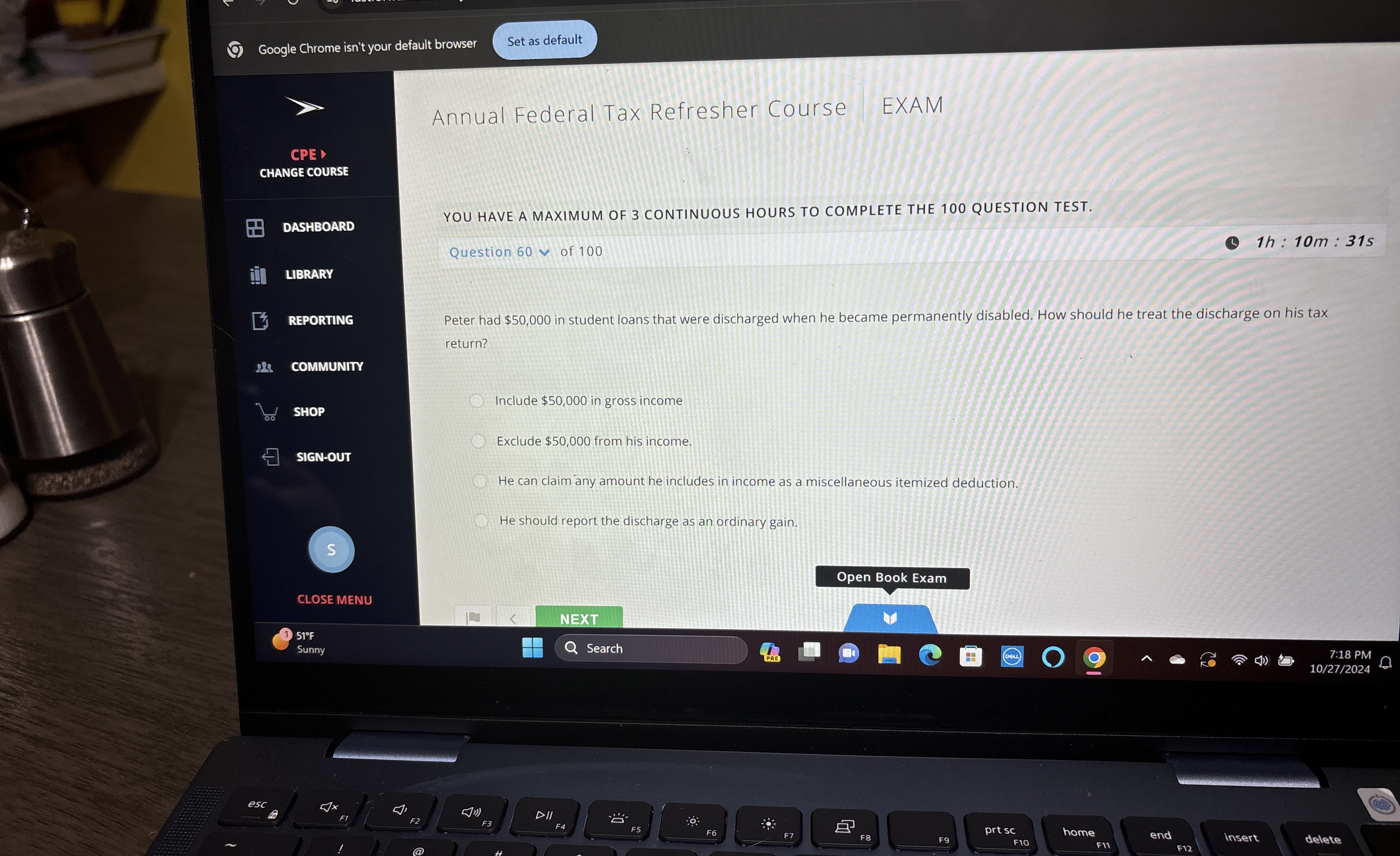

Annual Federal Tax Refresher Course

EXAM

CPE D

CHANGE COURSE

DASHBOARD

YOU HAVE A MAXIMUM OF CONTINUOUS HOURS TO COMPLETE THE QUESTION TEST.

Question of

::

LIBRARY

REPORTING

Peter had $ in student loans that were discharged when he became permanently disabled. How should he treat the discharge on his tax return?

Include $ in gross income

Exclude $ from his income.

He can claim any amount he includes in income as a miscellaneous itemized deduction.

He should report the discharge as an ordinary gain.

Open Book Exam

CLOSE MENU

Sunny

Search

: PM

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock