Question: (a) Please calculate Lakeside National Bank's total risk-weighted assets, based on the following items that the bank reported on its latest balance sheet. Does

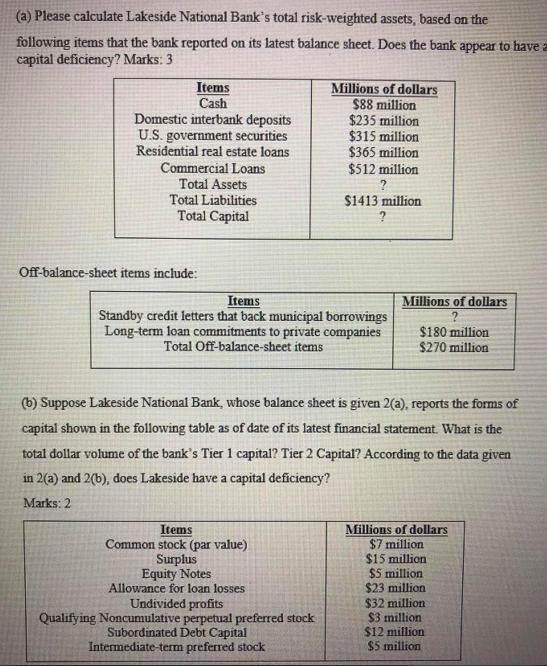

(a) Please calculate Lakeside National Bank's total risk-weighted assets, based on the following items that the bank reported on its latest balance sheet. Does the bank appear to have a capital deficiency? Marks: 3 Items Cash Domestic interbank deposits U.S. government securities Residential real estate loans Commercial Loans Total Assets Total Liabilities Total Capital Off-balance-sheet items include: Items Standby credit letters that back municipal borrowings Long-term loan commitments to private companies Total Off-balance-sheet items Items Common stock (par value) Surplus Millions of dollars $88 million $235 million $315 million $365 million $512 million ? $1413 million Equity Notes Allowance for loan losses (b) Suppose Lakeside National Bank, whose balance sheet is given 2(a), reports the forms of capital shown in the following table as of date of its latest financial statement. What is the total dollar volume of the bank's Tier 1 capital? Tier 2 Capital? According to the data given in 2(a) and 2(b), does Lakeside have a capital deficiency? Marks: 2 Undivided profits Qualifying Noncumulative perpetual preferred stock Subordinated Debt Capital Intermediate-term preferred stock Millions of dollars $180 million $270 million Millions of dollars $7 million $15 million $5 million $23 million $32 million $3 million $12 million $5 million

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts