Question: hello I need a step by step process for problem A and problem B:) thank you! Problem A (Ch 7S Your boss has told you

hello I need a step by step process for problem A and problem B:) thank you!

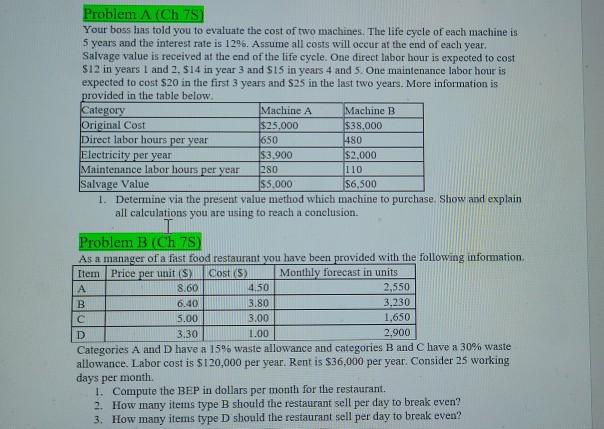

Problem A (Ch 7S Your boss has told you to evaluate the cost of two machines. The life cycle of each machine is 5 years and the interest rate is 129. Assume all costs will occur at the end of each year. Salvage value is received at the end of the life cycle. One direct labor hour is expeoted to cost S12 in years 1 and 2, 514 in year 3 and S15 in years 4 and 5. One maintenance labor hour is expected to cost $20 in the first 3 years and S25 in the last two years. More information is provided in the table below. Category Machine A Machine B Original Cost $25.000 $38.000 Direct labor hours per year 1650 1480 Electricity per year $3.900 $2,000 Maintenance labor hours per year 280 110 Salvage Value 55.000 $6,500 1. Determine via the present value metliod which machine to purchase. Show and explain all calculations you are using to reach a conclusion. Problem B (Ch 7S) As a manager of a fast food restaurant you have been provided with the following information Item Price per unit (SX Cost (5) Monthly forecast in units 8.60 4.50 2,550 B 6.40 3.80 3.230 5.00 3.00 1.650 D 3.30 1.00 2.900 Categories A and D have a 15% waste allowance and categories B and C have a 30% waste allowance. Labor cost is $120,000 per year. Rent is $36,000 per year. Consider 25 working days per month 1. Compute the BEP in dollars per month for the restaurant. 2. How many items type B should the restaurant sell per day to break even? 3. How many items type D should the restaurant sell per day to break even

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts