Question: Hello, I need help solving this accounting problem. S eCampus: Home Gradebook 5 Connect f Facebook C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252FIms.mheducation.com%252Fmghmiddleware%2.. G Paused + ili Apps Facebook Bookmarks

Hello, I need help solving this accounting problem.

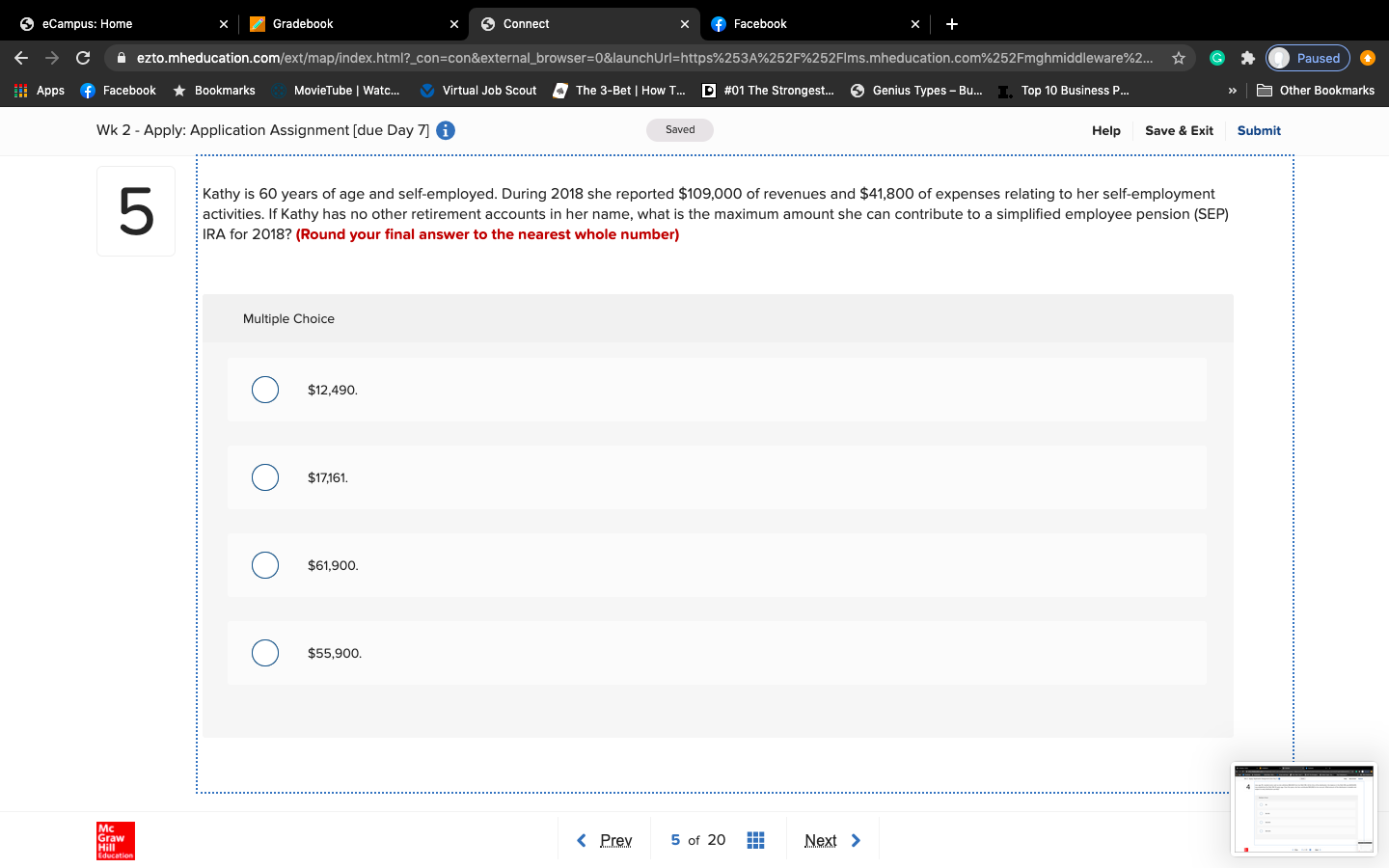

S eCampus: Home Gradebook 5 Connect f Facebook C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252FIms.mheducation.com%252Fmghmiddleware%2.. G Paused + ili Apps Facebook Bookmarks MovieTube | Watc... Virtual Job Scout The 3-Bet | How T... D #01 The Strongest. > Other Bookmarks Wk 2 - Apply: Application Assignment [due Day 7] Saved Help Save & Exit Submit 5 Kathy is 60 years of age and self-employed. During 2018 she reported $109,000 of revenues and $41,800 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to a simplified employee pension (SEP) IRA for 2018? (Round your final answer to the nearest whole number) Multiple Choice O $12,490. O $17,161. O $61,900. O $55,900. Mc Graw Hill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts