Question: Help me plsss Question 14 (1 point) You have been given the following coupon yield curve: Maturity (years) 1 12 3 14 10% 8% 10%

Help me plsss

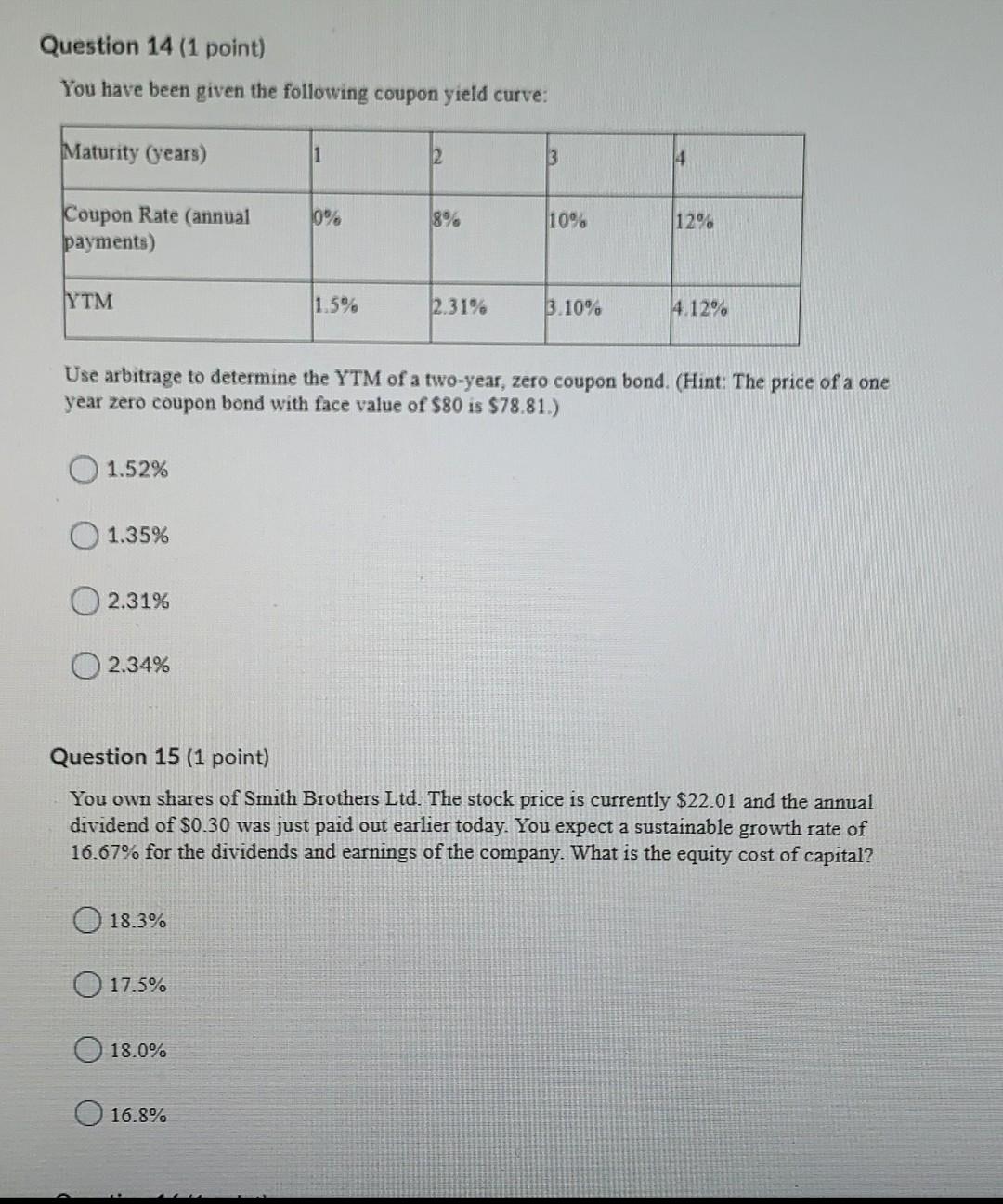

Question 14 (1 point) You have been given the following coupon yield curve: Maturity (years) 1 12 3 14 10% 8% 10% Coupon Rate (annual payments) 12% YTM 1.5% 2.31% 3.10% 4.12% Use arbitrage to determine the YTM of a two-year, zero coupon bond. (Hint: The price of a one year zero coupon bond with face value of $80 is $78.81.) 1.52% 1.35% 2.31% 2.34% Question 15 (1 point) You own shares of Smith Brothers Ltd. The stock price is currently $22.01 and the annual dividend of $0.30 was just paid out earlier today. You expect a sustainable growth rate of 16.67% for the dividends and earnings of the company. What is the equity cost of capital? O 18.3% O 17.5% 18.0% 16.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts