Question: help me solve step by step please and thank you. I'll thumbs up your answer as soon as you reply! its urgent please and thank

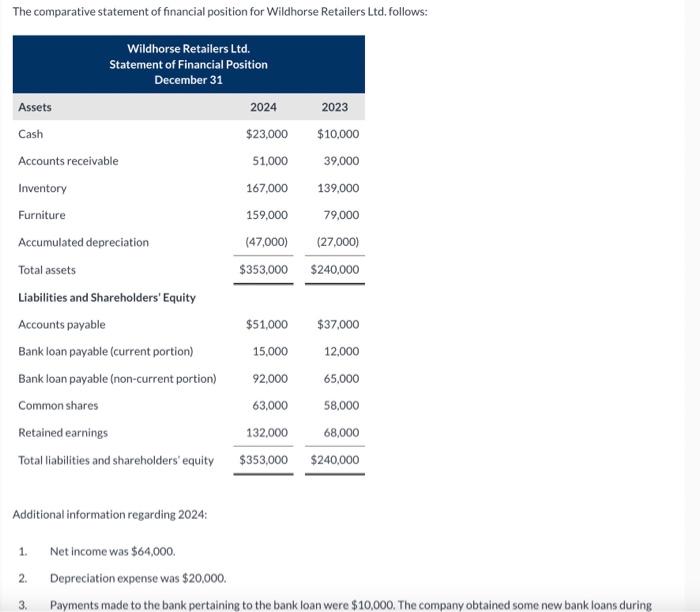

The comparative statement of financial position for Wildhorse Retailers Ltd. follows: Wildhorse Retailers Ltd. Statement of Financial Position December 31 Assets 2024 2023 Cash $23,000 $10,000 Accounts receivable 51,000 39,000 Inventory 167,000 139,000 Furniture 159,000 79,000 Accumulated depreciation (47,000) (27,000) Total assets $353,000 $240,000 Liabilities and Shareholders' Equity Accounts payable $51,000 $37,000 Bank loan payable (current portion) 15,000 12,000 Bank loan payable (non-current portion) 92,000 65,000 Common shares 63,000 58,000 Retained earnings 132,000 68,000 Total liabilities and shareholders' equity $353,000 $240,000 Additional information regarding 2024: 1. Net income was $64,000. 2. Depreciation expense was $20,000. 3. Payments made to the bank pertaining to the bank loan were $10,000. The company obtained some new bank loans during

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts