Question: help please! Net Operating Losses (LO 4.9) Tyler, a single taxpayer, generates business income of $3,000 in 2016 . In 2017 , he generates an

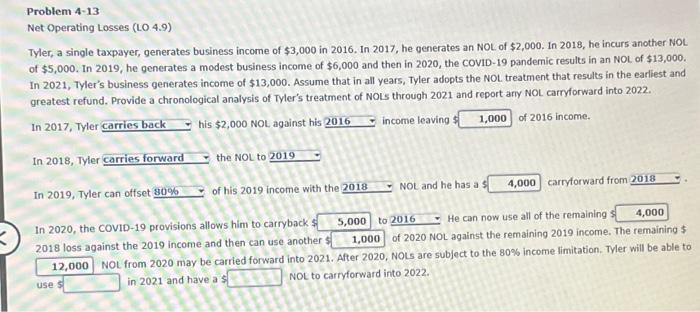

Net Operating Losses (LO 4.9) Tyler, a single taxpayer, generates business income of $3,000 in 2016 . In 2017 , he generates an NOL of $2,000. In 2018 , he incurs another NOL of $5,000. In 2019 , he generates a modest business income of $6,000 and then in 2020 , the COVID-19 pandemic results in an NOL of $13,000. In 2021, Tyler's business generates income of $13,000. Assume that in all years, Tyler adopts the NOL treatment that results in the earliest and greatest refund. Provide a chronological analysis of Tyler's treatment of NOLs through 2021 and report arry NOt carryforward into 2022. In 2017, Tyler his $2,000 NOL against his income leaving 5 of 2016 income. In 2018, Tyler the NOL to In 2019, Tyler can offset of his 2019 income with the NOL and he has a s carrytorward from In 2020, the COVID-19 provisions allows him to carryback 4 to He can now use all of the remaining : 2018 loss against the 2019 income and then can use another $ of 2020 NOL against the remaining 2019 income. The remaining $ NOL from 2020 may be carried forward into 2021. After 2020 , NOLs are subject to the 80% income limitation. Tyler will be able to use 5 in 2021 and have a $ NOL to carryforward into 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts