Question: Help Please schedules, or worksheets. Answer the question, including Form 1040 and all appropriate forms, When entering Social Security numbers (SSNs) or Employer Identification Numbers

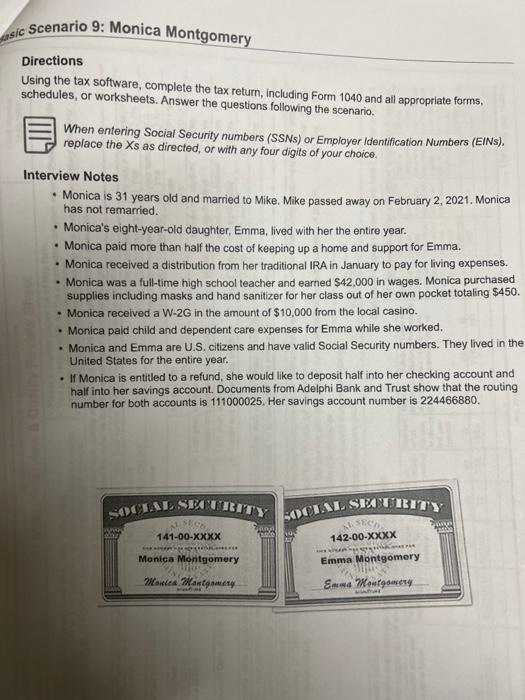

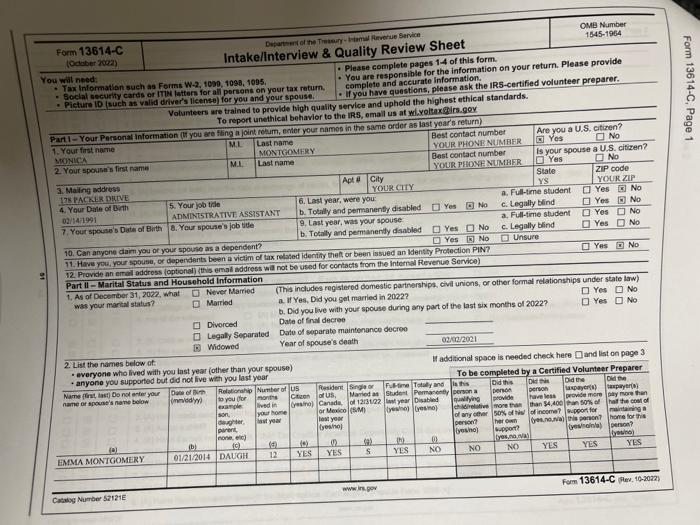

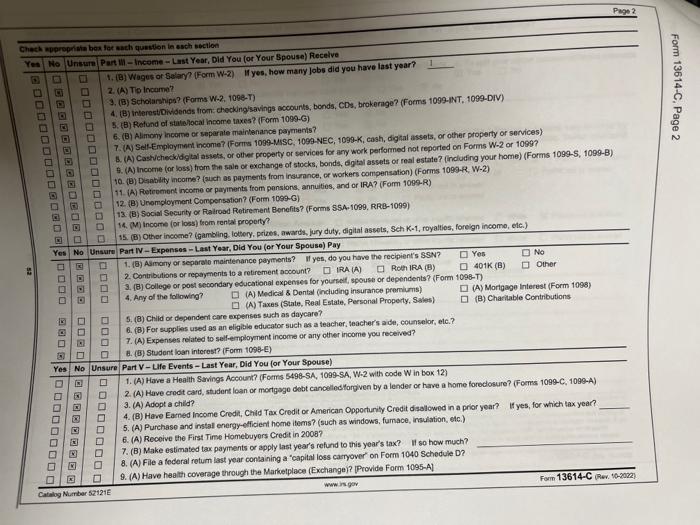

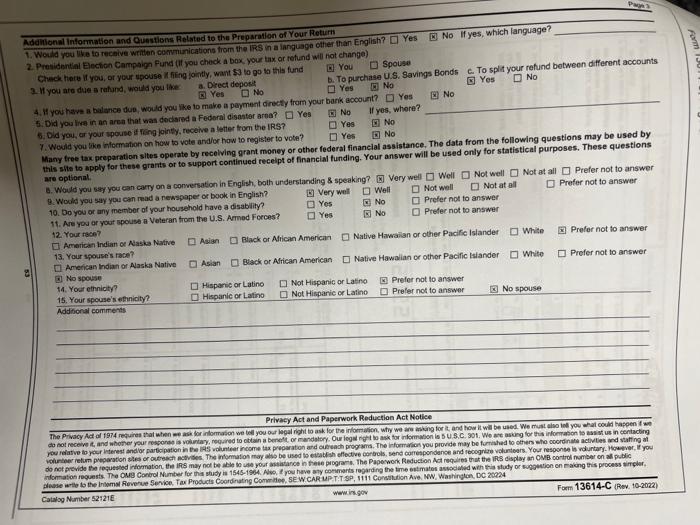

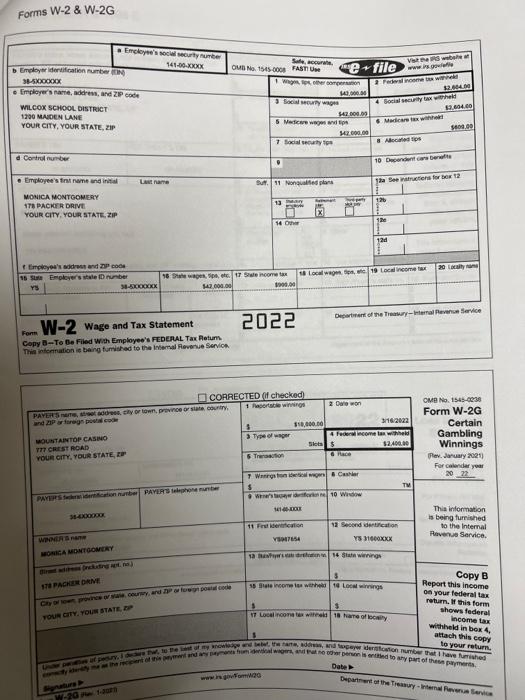

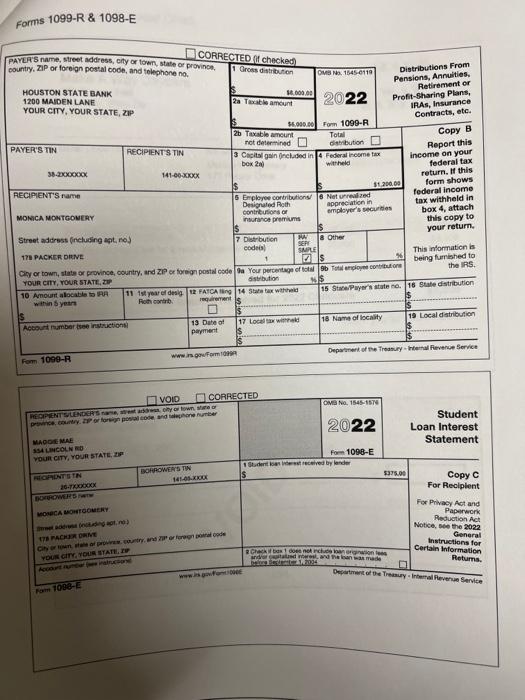

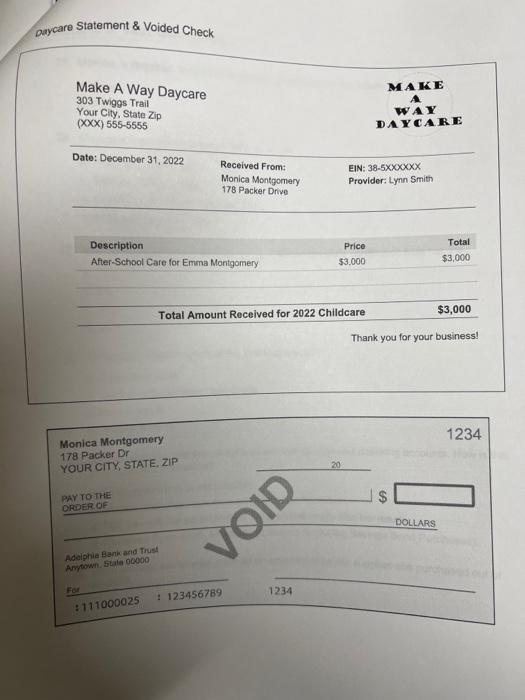

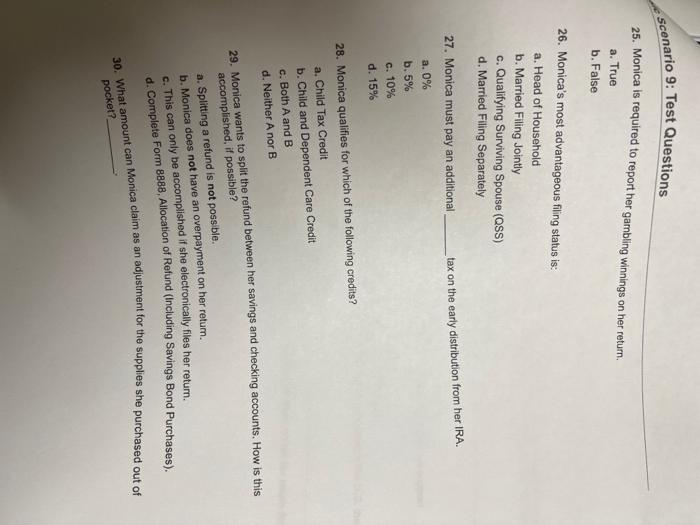

schedules, or worksheets. Answer the question, including Form 1040 and all appropriate forms, When entering Social Security numbers (SSNs) or Employer Identification Numbers (EINs), replace the X s as directed, or with any four digits of your choice. Interview Notes - Monica is 31 years old and married to Mike. Mike passed away on February 2, 2021. Monica has not remarried. - Monica's eight-year-old daughter, Emma, lived with her the entire year. - Monica paid more than half the cost of keeping up a home and support for Emma. - Monica received a distribution from her traditional IRA in January to pay for living expenses. - Monica was a full-time high school teacher and earned $42,000 in wages. Monica purchased supplies including masks and hand sanitizer for her class out of her own pocket totaling $450. - Monica recelved a W2G in the amount of $10,000 from the local casino. - Monica paid child and dependent care expenses for Emma while she worked. - Monica and Emma are U.S. citizens and have valid Social Security numbers. They lived in the United States for the entire year. - If Monica is entitled to a refund, she would like to deposit half into her checking account and half into her savings account. Documents from Adelphi Bank and Trust show that the routing number for both accounts is 111000025 . Her savings account number is 224466880 . Cataleg Number Sat121E Catallog Number 52121 E Mdilionil information and Ounstions Retsted to the Prepsration of Your Return 2. Presigential Eloction Campaign Fund (lt you check a box your tax or refund witi not change) Chack there it you, of your spouise if fieng iointly, want \$3 la go ta this fund []. You Ypouse 3. Il you ate due a rahund, would you tike: a. Drect depori 5. Did you live in an area that was dedared a Federal disaster area? Yes in No If yos, whore? Many tree tax preparation sites operate by recelving grant money or othor federal financlal assistance. The data from the foliowing questions mal purposes. These questions this site to apply for these grarts of to support continued recelpt of financial funding. Your ansu are optional. 9. Would you say you can read a newspape of book in English? 12 Your rsce? [] Prefer not to answer [. American indian of Naska Native Asign Black or Arican American Native Hawailan or other Pacife Islander White 13. Your spouse's race? A American indian or Alaska Native Asian Biack or African American Native Hawalian or other Pacific tsiander 14. Your ethnicty? Hisparic or Latino Not Hispanic or Lasino Prefor not to answer Preler not to answer No spouse 15. Your spouse's ethniaity? Hispanic or Latino Not Hisparic or Latino Addificral cominents Forms W-2 \& W-2G Copy b To oe filed Wha Employeo's FeDerut Tax hotum Forms 1099-R \& 1098-E PAYL's name, street address, ofy or town, state or provinos, CORECTED (ff checked] country, ZIP or foreign postal code, and tolephone no. Oepostient of Te Troasuy - Ihteral Fievenise Service Fom 1099R paycare Statement \& Voided Check Make A Way Daycare 303 Twiggs Trail Your City, State Zip ( (XX) 555-5555 Monica Montgomery 1234 178 Packer Dr YOUR CITY, STATE, ZIP BAVTO THE $ DOLLARS Adeiphie Eankend Trust Ampown. Fitale 00000 :1110000251234567891234 For 25. Monica is required to report her gambling winnings on her return. a. True b. False 26. Monica's most advantageous filing status is: a. Head of Household b. Married Filing Jointly c. Qualifying Surviving Spouse (QSS) d. Married Filing Separately 27. Monica must pay an additional tax on the early distribution from her IRA. a. 0% b. 5% c. 10% d. 15% 28. Monica qualifies for which of the following credits? a. Child Tax Credit b. Child and Dependent Care Credit c. Both A and B d. Neither A nor B 29. Monica wants to split the refund between her savings and checking accounts. How is this accomplished, if possible? a. Splitting a refund is not possible. b. Monica does not have an overpayment on her retum. c. This can only be accomplished if she electronically files her return. d. Complete Form 8888, Allocation of Refund (Including Savings Bond Purchases). 30. What amount can Monica claim as an adjustment for the supplies she purchased out of pocket? schedules, or worksheets. Answer the question, including Form 1040 and all appropriate forms, When entering Social Security numbers (SSNs) or Employer Identification Numbers (EINs), replace the X s as directed, or with any four digits of your choice. Interview Notes - Monica is 31 years old and married to Mike. Mike passed away on February 2, 2021. Monica has not remarried. - Monica's eight-year-old daughter, Emma, lived with her the entire year. - Monica paid more than half the cost of keeping up a home and support for Emma. - Monica received a distribution from her traditional IRA in January to pay for living expenses. - Monica was a full-time high school teacher and earned $42,000 in wages. Monica purchased supplies including masks and hand sanitizer for her class out of her own pocket totaling $450. - Monica recelved a W2G in the amount of $10,000 from the local casino. - Monica paid child and dependent care expenses for Emma while she worked. - Monica and Emma are U.S. citizens and have valid Social Security numbers. They lived in the United States for the entire year. - If Monica is entitled to a refund, she would like to deposit half into her checking account and half into her savings account. Documents from Adelphi Bank and Trust show that the routing number for both accounts is 111000025 . Her savings account number is 224466880 . Cataleg Number Sat121E Catallog Number 52121 E Mdilionil information and Ounstions Retsted to the Prepsration of Your Return 2. Presigential Eloction Campaign Fund (lt you check a box your tax or refund witi not change) Chack there it you, of your spouise if fieng iointly, want \$3 la go ta this fund []. You Ypouse 3. Il you ate due a rahund, would you tike: a. Drect depori 5. Did you live in an area that was dedared a Federal disaster area? Yes in No If yos, whore? Many tree tax preparation sites operate by recelving grant money or othor federal financlal assistance. The data from the foliowing questions mal purposes. These questions this site to apply for these grarts of to support continued recelpt of financial funding. Your ansu are optional. 9. Would you say you can read a newspape of book in English? 12 Your rsce? [] Prefer not to answer [. American indian of Naska Native Asign Black or Arican American Native Hawailan or other Pacife Islander White 13. Your spouse's race? A American indian or Alaska Native Asian Biack or African American Native Hawalian or other Pacific tsiander 14. Your ethnicty? Hisparic or Latino Not Hispanic or Lasino Prefor not to answer Preler not to answer No spouse 15. Your spouse's ethniaity? Hispanic or Latino Not Hisparic or Latino Addificral cominents Forms W-2 \& W-2G Copy b To oe filed Wha Employeo's FeDerut Tax hotum Forms 1099-R \& 1098-E PAYL's name, street address, ofy or town, state or provinos, CORECTED (ff checked] country, ZIP or foreign postal code, and tolephone no. Oepostient of Te Troasuy - Ihteral Fievenise Service Fom 1099R paycare Statement \& Voided Check Make A Way Daycare 303 Twiggs Trail Your City, State Zip ( (XX) 555-5555 Monica Montgomery 1234 178 Packer Dr YOUR CITY, STATE, ZIP BAVTO THE $ DOLLARS Adeiphie Eankend Trust Ampown. Fitale 00000 :1110000251234567891234 For 25. Monica is required to report her gambling winnings on her return. a. True b. False 26. Monica's most advantageous filing status is: a. Head of Household b. Married Filing Jointly c. Qualifying Surviving Spouse (QSS) d. Married Filing Separately 27. Monica must pay an additional tax on the early distribution from her IRA. a. 0% b. 5% c. 10% d. 15% 28. Monica qualifies for which of the following credits? a. Child Tax Credit b. Child and Dependent Care Credit c. Both A and B d. Neither A nor B 29. Monica wants to split the refund between her savings and checking accounts. How is this accomplished, if possible? a. Splitting a refund is not possible. b. Monica does not have an overpayment on her retum. c. This can only be accomplished if she electronically files her return. d. Complete Form 8888, Allocation of Refund (Including Savings Bond Purchases). 30. What amount can Monica claim as an adjustment for the supplies she purchased out of pocket

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts