Question: Hey im having troubles with this problem. can someone show me with work shown so i can understand how it was done. Suppose on January

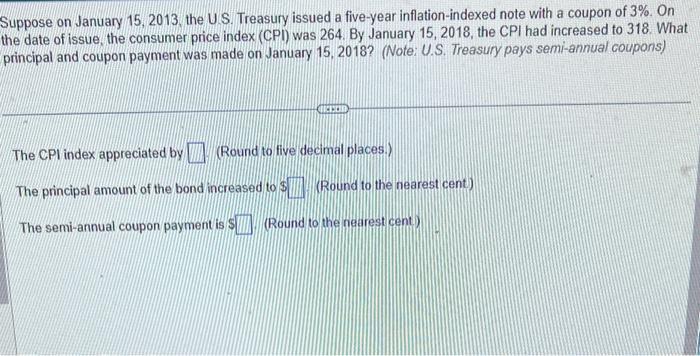

Suppose on January 15, 2013. the U.S. Treasury issued a five-year inflation-indexed note with a coupon of 3%. On the date of issue, the consumer price index (CPI) was 264. By January 15, 2018, the CPI had increased to 318 . What principal and coupon payment was made on January 15, 2018? (Note: U.S. Treasury pays semi-annual coupons) The CPI index appreciated by (Round to five decimal places.) The principal amount of the bond increased to $ (Round to the nearest cent) The semi-annual coupon payment is \$ (Round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts