Question: Hey im having troubles with this problem. can someone show me with work shown so i can understand how it was done. Assume that Microsoft

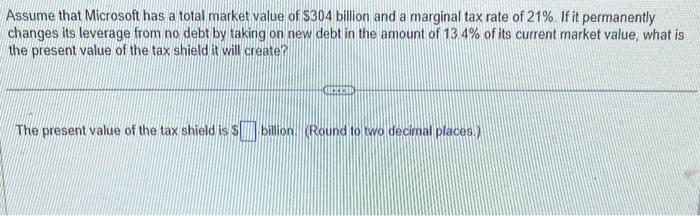

Assume that Microsoft has a total market value of $304 billion and a marginal tax rate of 21%. If it permanently changes its leverage from no debt by taking on new debt in the amount of 13.4% of its current market value, what is the present value of the tax shield it will create? The present value of the tax shield is $ billon . (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts