Question: hi, please answer all question (a through f) thanks! 2. Using the following information: 11s 2- long term debt is borrowed for more than one

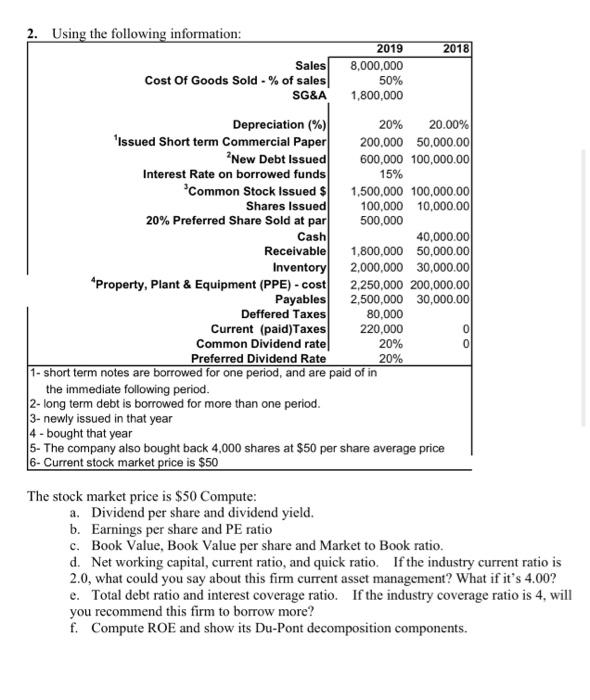

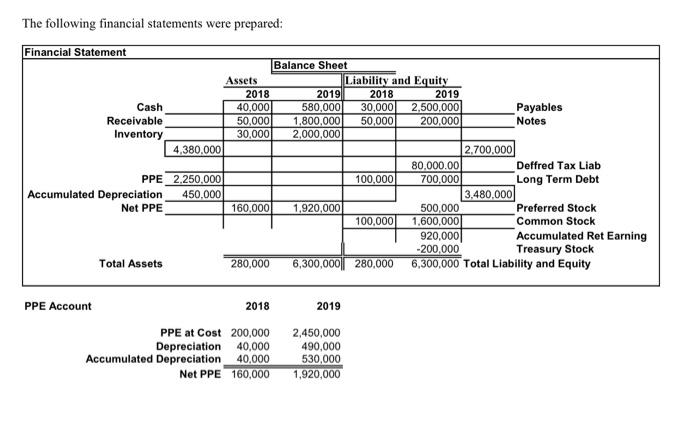

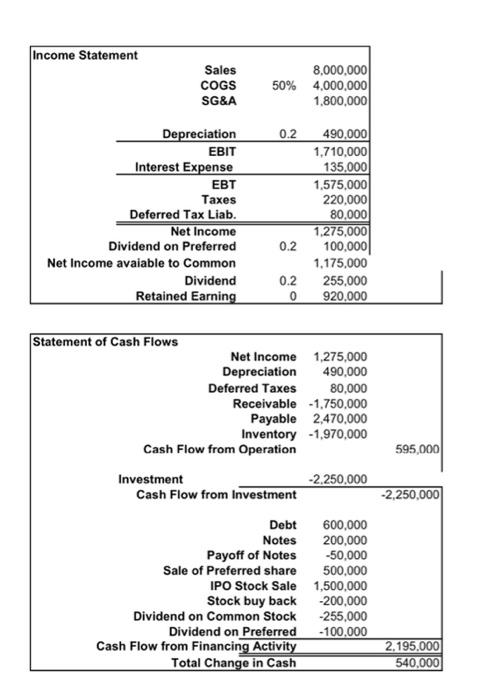

2. Using the following information: 11s 2- long term debt is borrowed for more than one period. 3- newly issued in that year 4 - bought that year 5- The company also bought back 4,000 shares at $50 per share average price 6- Current stock market price is $50 The stock market price is $50 Compute: a. Dividend per share and dividend yield. b. Earnings per share and PE ratio c. Book Value, Book Value per share and Market to Book ratio. d. Net working capital, current ratio, and quick ratio. If the industry current ratio is 2.0, what could you say about this firm current asset management? What if it's 4.00 ? e. Total debt ratio and interest coverage ratio. If the industry coverage ratio is 4 , will you recommend this firm to borrow more? f. Compute ROE and show its Du-Pont decomposition components. The following financial statements were prepared

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts