Question: Hi, there is no missing information from the problem. I am struggling with the entire problem and would love a step by step guide of

Hi, there is no missing information from the problem. I am struggling with the entire problem and would love a step by step guide of the answers. Thanks.

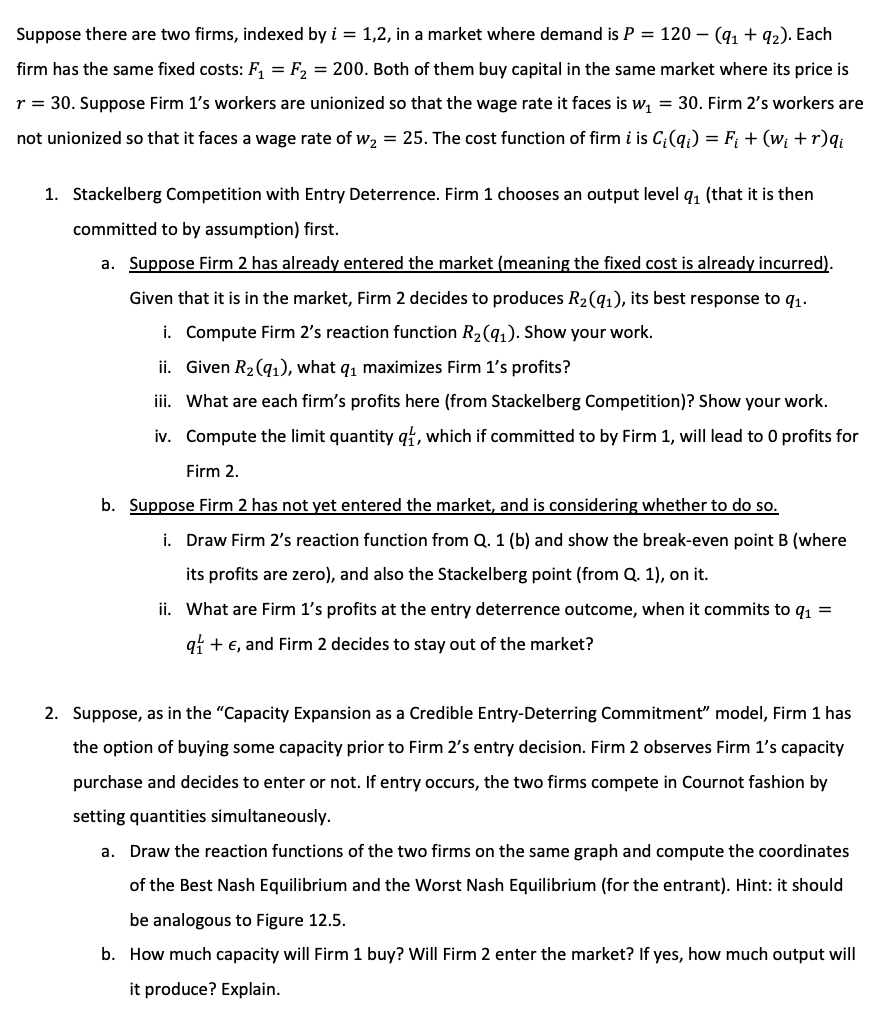

Suppose there are two firms, indexed by i = 1,2, in a market where demand is P = 120 - (q1 + q2). Each firm has the same fixed costs: F1 = F2 = 200. Both of them buy capital in the same market where its price is r = 30. Suppose Firm 1's workers are unionized so that the wage rate it faces is wj = 30. Firm 2's workers are not unionized so that it faces a wage rate of w2 = 25. The cost function of firm i is C; (q)) = Fi + (wi + r)qi 1. Stackelberg Competition with Entry Deterrence. Firm 1 chooses an output level q, (that it is then committed to by assumption) first. a. Suppose Firm 2 has already entered the market (meaning the fixed cost is already incurred). Given that it is in the market, Firm 2 decides to produces R2 (q1), its best response to q1. i. Compute Firm 2's reaction function R2 (q1). Show your work. ii. Given R2(q1), what q1 maximizes Firm 1's profits? iii. What are each firm's profits here (from Stackelberg Competition)? Show your work. iv. Compute the limit quantity q1, which if committed to by Firm 1, will lead to 0 profits for Firm 2. b. Suppose Firm 2 has not yet entered the market, and is considering whether to do so. i. Draw Firm 2's reaction function from Q. 1 (b) and show the break-even point B (where its profits are zero), and also the Stackelberg point (from Q. 1), on it. ii. What are Firm 1's profits at the entry deterrence outcome, when it commits to q1 = qr + E, and Firm 2 decides to stay out of the market? 2. Suppose, as in the "Capacity Expansion as a Credible Entry-Deterring Commitment" model, Firm 1 has the option of buying some capacity prior to Firm 2's entry decision. Firm 2 observes Firm 1's capacity purchase and decides to enter or not. If entry occurs, the two firms compete in Cournot fashion by setting quantities simultaneously. a. Draw the reaction functions of the two firms on the same graph and compute the coordinates of the Best Nash Equilibrium and the Worst Nash Equilibrium (for the entrant). Hint: it should be analogous to Figure 12.5. b. How much capacity will Firm 1 buy? Will Firm 2 enter the market? If yes, how much output will it produce? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts