Question: Home Insert Shar S U , B6-Developing a Model GLORI... Draw Page Layout Formulas Data Review View A. 3 . % - 2 conditional Formatting

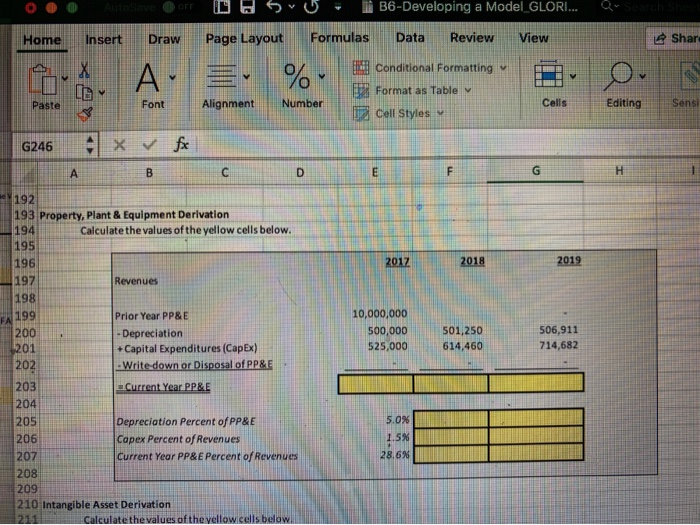

Home Insert Shar S U , B6-Developing a Model GLORI... Draw Page Layout Formulas Data Review View A. 3 . % - 2 conditional Formatting 13 Format as Table 2 Cell Styles v fx Paste Alignment Number Editing Sensi G246 X 193 Property, Plant & Equipment Derivation Calculate the values of the yellow cells below. 2017 2018 2019 Revenues Prior Year PP&E - Depreciation Capital Expenditures (Capex) Write down or Disposal of PP&E Current Year PP&E 10,000,000 500,000 525,000 501,250 614,460 506,911 714,682 28.6% Depreciation Percent of PP&E Capex Percent of Revenues 207 Current Year PP&E Percent of Revenues 208 209 210 Intangible Asset Derivation Calculate the values of the yellow cells below. Home Insert Shar S U , B6-Developing a Model GLORI... Draw Page Layout Formulas Data Review View A. 3 . % - 2 conditional Formatting 13 Format as Table 2 Cell Styles v fx Paste Alignment Number Editing Sensi G246 X 193 Property, Plant & Equipment Derivation Calculate the values of the yellow cells below. 2017 2018 2019 Revenues Prior Year PP&E - Depreciation Capital Expenditures (Capex) Write down or Disposal of PP&E Current Year PP&E 10,000,000 500,000 525,000 501,250 614,460 506,911 714,682 28.6% Depreciation Percent of PP&E Capex Percent of Revenues 207 Current Year PP&E Percent of Revenues 208 209 210 Intangible Asset Derivation Calculate the values of the yellow cells below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts