Question: how do you do these ? Question 1 Make the necessary assumptions to solve this question. Be sure to answer all sub questions. Explain your

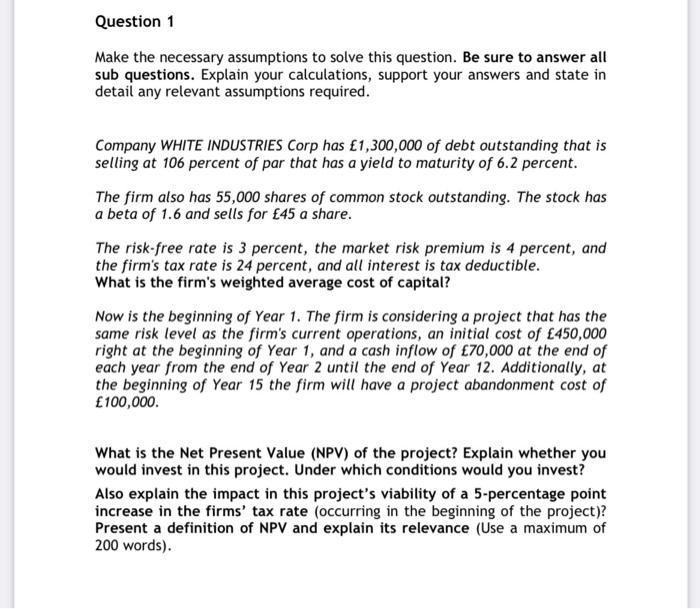

Question 1 Make the necessary assumptions to solve this question. Be sure to answer all sub questions. Explain your calculations, support your answers and state in detail any relevant assumptions required. Company WHITE INDUSTRIES Corp has 1,300,000 of debt outstanding that is selling at 106 percent of par that has a yield to maturity of 6.2 percent. The firm also has 55,000 shares of common stock outstanding. The stock has a beta of 1.6 and sells for 45 a share. The risk-free rate is 3 percent, the market risk premium is 4 percent, and the firm's tax rate is 24 percent, and all interest is tax deductible. What is the firm's weighted average cost of capital? Now is the beginning of Year 1. The firm is considering a project that has the same risk level as the firm's current operations, an initial cost of 450,000 right at the beginning of Year 1, and a cash inflow of 70,000 at the end of each year from the end of Year 2 until the end of Year 12. Additionally, at the beginning of Year 15 the firm will have a project abandonment cost of 100,000 What is the Net Present Value (NPV) of the project? Explain whether you would invest in this project. Under which conditions would you invest? Also explain the impact in this project's viability of a 5-percentage point increase in the firms' tax rate (occurring in the beginning of the project)? Present a definition of NPV and explain its relevance (Use a maximum of 200 words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts