Question: How to calculate this problem? Question 2 0 / 1 pts The risk-free asset has a return of 1.8%. The optimal risky portfolio has a

How to calculate this problem?

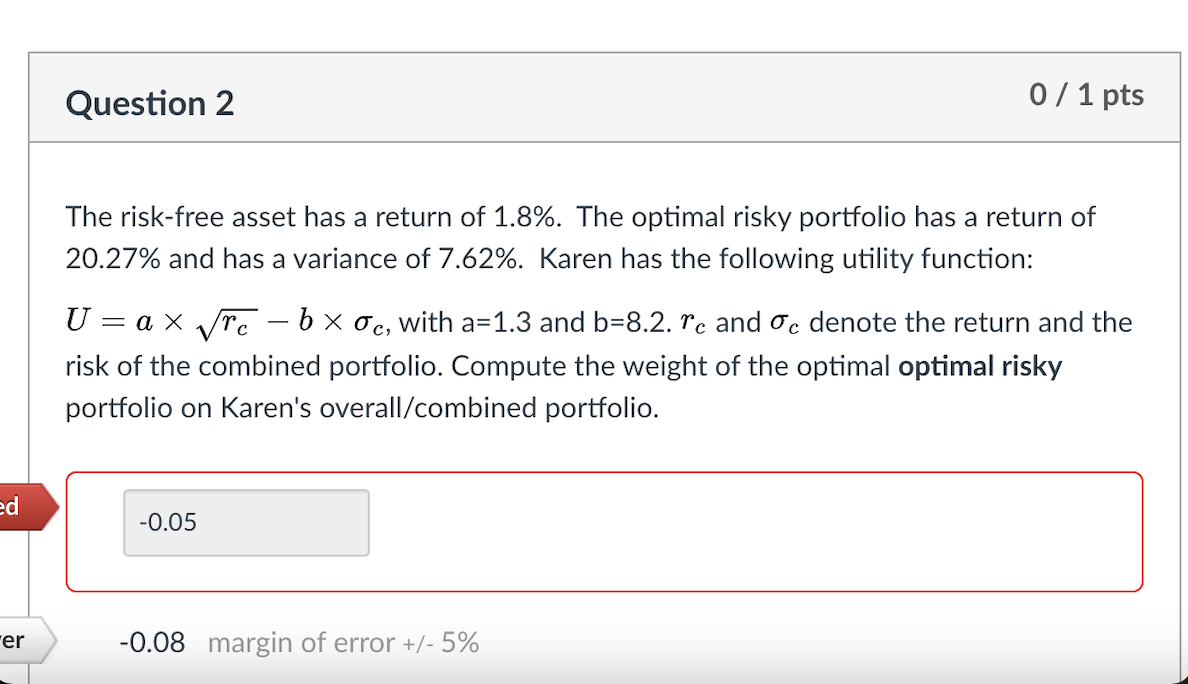

Question 2 0 / 1 pts The risk-free asset has a return of 1.8%. The optimal risky portfolio has a return of 20.27% and has a variance of 7.62%. Karen has the following utility function: U = ax Vrc 6 x 0c, with a=1.3 and b=8.2. re and Oc denote the return and the risk of the combined portfolio. Compute the weight of the optimal optimal risky portfolio on Karen's overall/combined portfolio. ed -0.05 er -0.08 margin of error +/-5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts