Question: how to solve 3.5 and 3.6 3. This exercise explores the nature of insurance contracts. We examine a pervasive feature of actual insurance contractsa requirement

how to solve 3.5 and 3.6

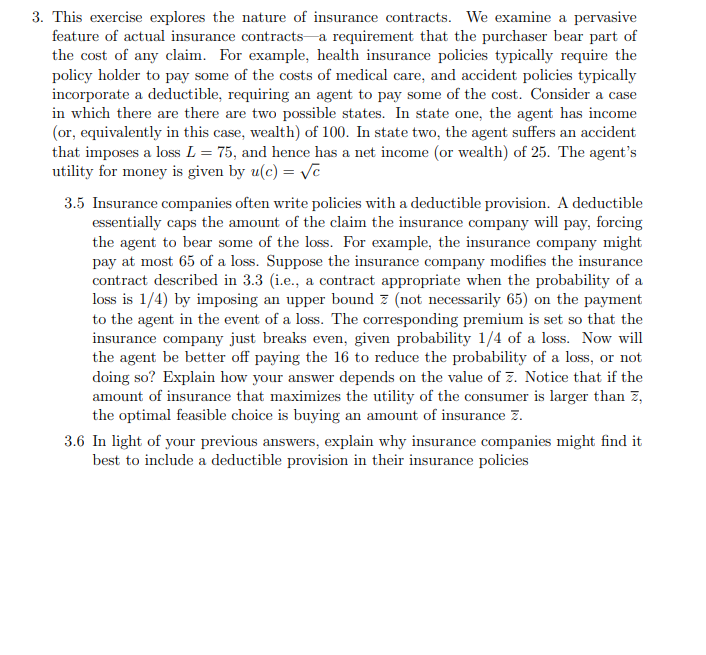

3. This exercise explores the nature of insurance contracts. We examine a pervasive feature of actual insurance contractsa requirement that the purchaser bear part of the cost of any claim. For example, health insurance policies typically require the policy holder to pay some of the costs of medical care, and accident policies typically incorporate a deductible, requiring an agent to pay some of the cost. Consider a case in which there are there are two possible states. In state one, the agent has income (or, equivalently in this case, wealth} of IUD. In state two, the agent suffers an accident that imposes a loss L = 75, and hence has a net income [or wealth} of 25. The agenth utility for money is given by u[c]l = V\"? 3.5 Insurance companies often write policies with a deductible provision. A deductible essentially caps the amount of the claim the insurance company will pay, forcing the agent to bear some of the loss. For example, the insurance company might pay at most 65 of a loss. Suppose the insurance company modifies the insurance contract described in 3.3 {i.e., a contract appropriate when the probability of a loss is 1K4) by imposing an upper bound E {not necessarily 55} on the payment to the agent in the event of a loss. The corresponding premium is set so that the insurance company just breaks even, given probability 1K4 of a loss. Now will the agent be better off paying the 15 to reduce the probability of a loss, or not doing so'iI Explain how your answer depends on the value of E. Notice that if the amount of insurance that maximizes the utility of the consumer is larger than E, the optimal feasible choice is buying an amount of insurance E. 3.5 In light of your previous answers, explain why insurance companies might nd it best to include a deductible pmvision in their insurance policies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts