Question: How would you interpret and compare the data from the table and bar graph from Company M and Company JWN? Keep the following questions in

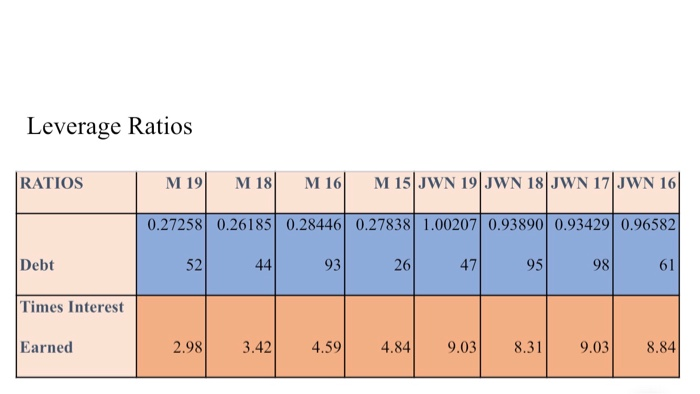

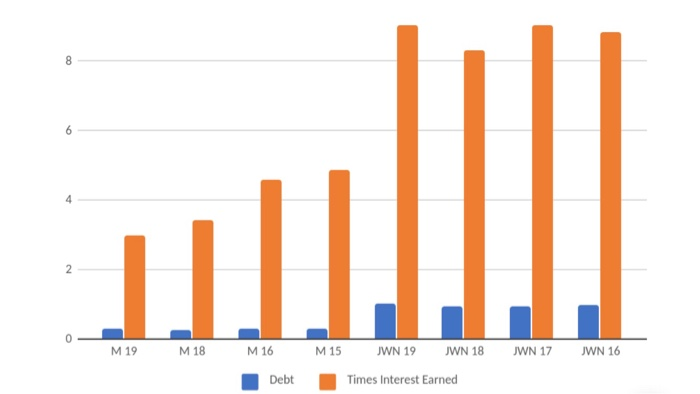

Leverage Ratios RATIOS M 190 M 18 M 16 M 15 JWN 19 JWN 18|JWN 17|JWN 16| 0.27258 0.26185 0.28446 0.27838 1.00207 0.93890 0.93429 0.96582 Debt 52 44 93 20 47 95 98 Times Interest Earned 2.98 3.42 4.59 4.84 9.03 8.31 .03 8.84 M19 M18 JWN 17 JWN 16 M16 Debt M15 JWN 19 JWN 18 Times Interest Earned Leverage Ratios RATIOS M 190 M 18 M 16 M 15 JWN 19 JWN 18|JWN 17|JWN 16| 0.27258 0.26185 0.28446 0.27838 1.00207 0.93890 0.93429 0.96582 Debt 52 44 93 20 47 95 98 Times Interest Earned 2.98 3.42 4.59 4.84 9.03 8.31 .03 8.84 M19 M18 JWN 17 JWN 16 M16 Debt M15 JWN 19 JWN 18 Times Interest Earned

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts