Question: How would you interpret and compare the data from the table and bar graph for Company M and Company JWN? Keep the folowing questions when

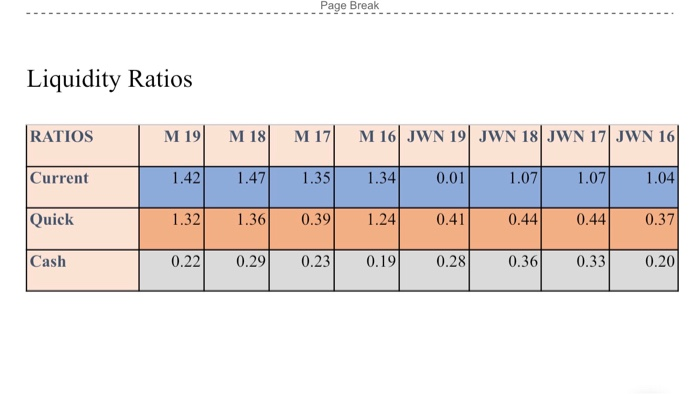

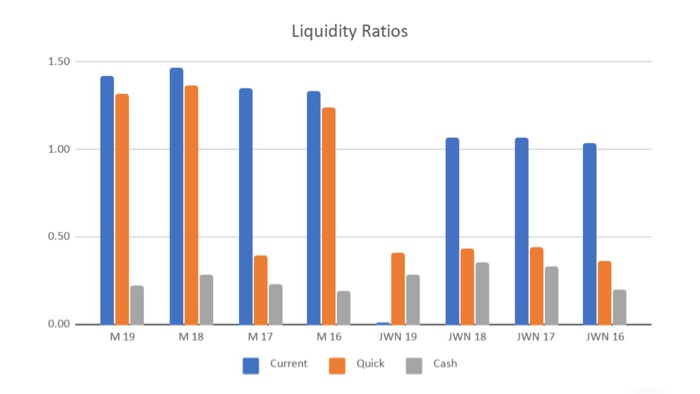

Cash Quick Leeo gco sro oro ero 670 220 LEO ro ro ito tri 660 ET EL to'l Lol Loi 100 ter sei Lt vi 91 NMP 21 NMC |81 NMP (61 NMC (91W LIW 81 | W | Current RATIOS Liquidity Ratios Page Break Liquidity Ratios 1.50 1.00 0.50 0.00 - M 19 M 18 M17 M16 JWN 19 JWN 18 WN 17 JWN 16 Current Quick Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts