Question: I dont get the answer, I want the answer. The expected returns and betas of two stocks A & B are shown in the table

I dont get the answer, I want the answer.

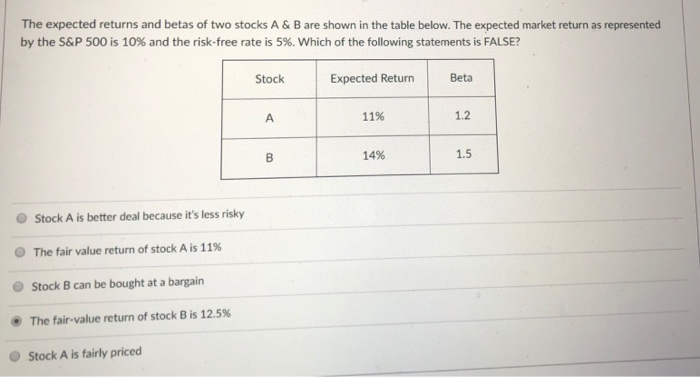

The expected returns and betas of two stocks A & B are shown in the table below. The expected market return as represented by the S&P 500 is 10% and the risk-free rate is 5%, which of the following statements is FALSE? Stock Expected ReturnBeta 11% 1.2 14% 1.5 O Stock A is better deal because it's less risky The fair value return of stock A is 11% O Stock B can be bought at a bargain The fair-value return of stock B is 12.5% O Stock A is fairly priced

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock