Question: I have part A so I just need B. Can you please show all work and work it out step by step so it is

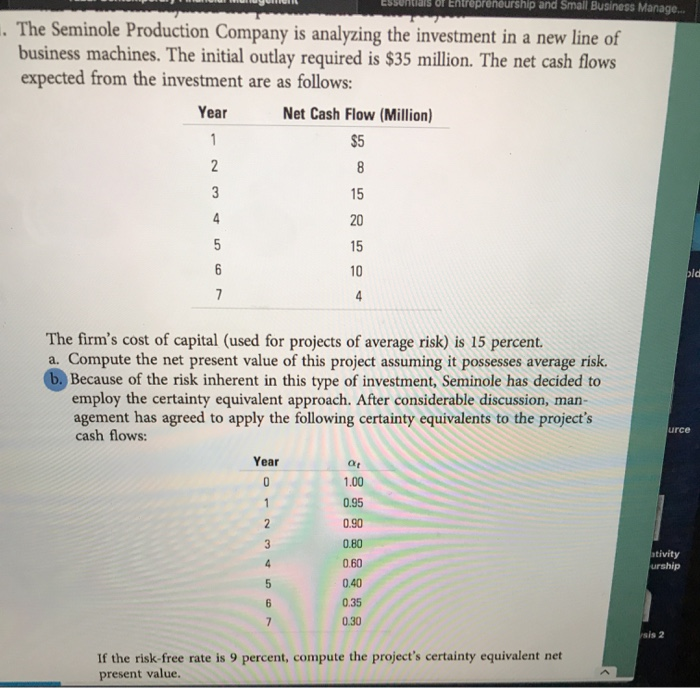

Essuntis or Entrepreneurship and Small Business Manage... . The Seminole Production Company is analyzing the investment in a new line of business machines. The initial outlay required is $35 million. The net cash flows expected from the investment are as follows: Net Cash Flow (Million) Year The firm's cost of capital (used for projects of average risk) is 15 percent. a. Compute the net present value of this project assuming it possesses average risk. b. Because of the risk inherent in this type of investment, Seminole has decided to employ the certainty equivalent approach. After considerable discussion, man agement has agreed to apply the following certainty equivalents to the project's cash flows: Year urce 0.95 0.90 ativity urship If the risk-free rate is 9 percent, compute the project's certainty equivalent net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts