Question: I need 100% correct answer by hands when you do the table no Excel or any prgrams . I. Zeon, a large, profitable corporation, is

I need 100% correct answer by hands when you do the table no Excel or any prgrams .

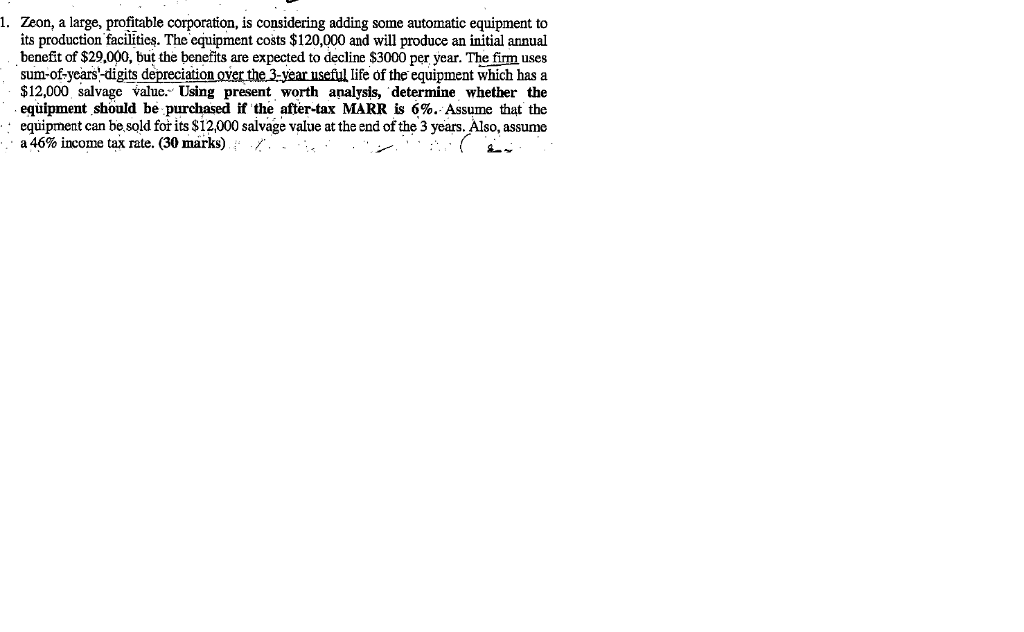

I. Zeon, a large, profitable corporation, is considering adding some automatic equipment to its production facilities. The equipment costs $120,000 and will produce an initial annual benefit of $29.000, but the benefits are expected to decline $3000 per year. The firm uses sum-of-years'-digits depreciation over the 3-vear useful life of the equipment which has a $12,000, salvage value. Using present worth analysis, determine whether the equipment should be purchased if the after-tax MARR is 6%. Assume that the equipment can be sold for its $12,000 salvage value at the end of the 3 years. Also, assume a 46% income tax rate. (30 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts