Question: I need explanations on why the answer is correct. If a question requires a numerical answer, provide a formula that helps to solve it. Fundamental

I need explanations on why the answer is correct. If a question requires a numerical answer, provide a formula that helps to solve it.

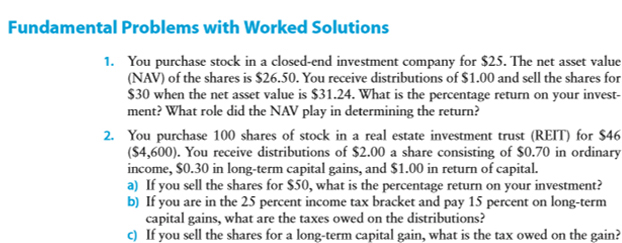

Fundamental Problems with Worked Solutions 1. You purchase stock in a closed-end investment company for $25. The net asset value (NAV) of the shares is $26.50. You receive distributions of $1.00 and sell the shares for $30 when the net asset value is $31.24. What is the percentage return on your invest- ment? What role did the NAV play in determining the return? 2. You purchase 100 shares of stock in a real estate investment trust (REIT) for $46 (54,600). You receive distributions of $2.00 a share consisting of $0.70 in ordinary income, $0.30 in long-term capital gains, and $1.00 in return of capital. a) If you sell the shares for $50, what is the percentage return on your investment? b) If you are in the 25 percent income tax bracket and pay 15 percent on long-term capital gains, what are the taxes owed on the distributions? c) If you sell the shares for a long-term capital gain, what is the tax owed on the gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts