Question: i need help with question 1 Instructions: Solve the following problems and answer related questions on separate answer sheet and upload your solutions to black

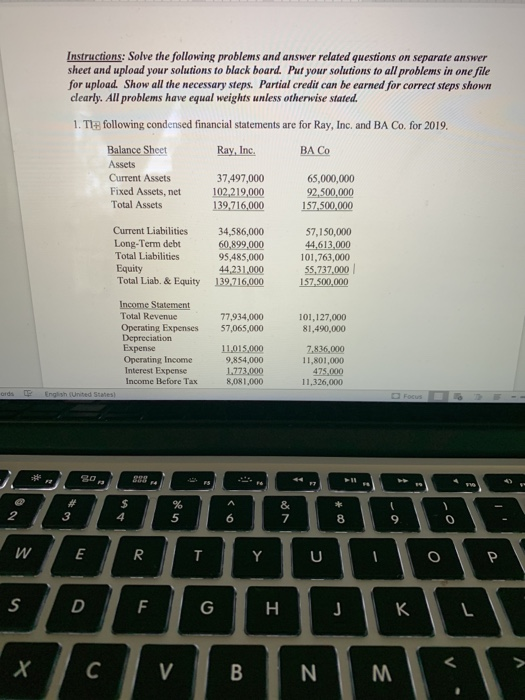

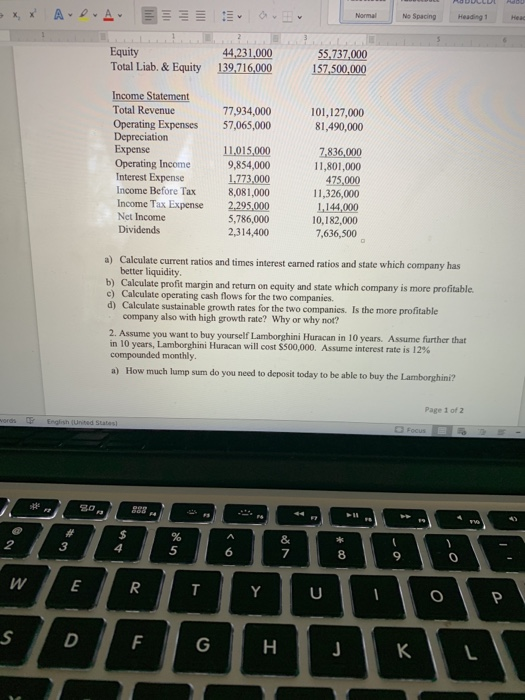

Instructions: Solve the following problems and answer related questions on separate answer sheet and upload your solutions to black board. Put your solutions to all problems in one file for upload. Show all the necessary steps. Partial credit can be earned for correct steps shown clearly. All problems have equal weights unless otherwise stated. 1. The following condensed financial statements are for Ray, Inc. and BA Co. for 2019. Ray, Inc. BACO Balance Sheet Assets Current Assets Fixed Assets, net Total Assets 37,497,000 102,219,000 139,716,000 65,000,000 92,500,000 157.500,000 Current Liabilities Long-Term debt Total Liabilities Equity Total Liab. & Equity 34,586,000 60,899,000 95,485,000 44,231,000 139,716,000 57,150,000 44,613,000 101,763,000 55,737,000 157.500,000 77,934,000 57,065,000 101,127,000 81,490,000 Income Statement Total Revenue Operating Expenses Depreciation Expense Operating Income Interest Expense Income Before Tax 11.015.000 9,854,000 1.773,000 BON 1.000 7,836,000 11,801.000 475.000 11,326.000 XX ADA SEO No Spacing Heading 1 Equity Total Liab. & Equity 44,231,000 139,716,000 55,737,000 157,500,000 77,934,000 57,065,000 101,127,000 81,490,000 Income Statement Total Revenue Operating Expenses Depreciation Expense Operating Income Interest Expense Income Before Tax Income Tax Expense Net Income Dividends 11.015,000 9,854,000 1.773.000 8,081,000 2.295,000 5,786,000 2,314,400 7,836,000 11,801,000 475,000 11,326,000 1,144.000 10,182,000 7,636,500 a) Calculate current ratios and times interest earned ratios and state which company has better liquidity b) Calculate profit margin and return on equity and state which company is more profitable c) Calculate operating cash flows for the two companies d) Calculate sustainable growth rates for the two companies. Is the more profitable company also with high growth rate? Why or why not? 2. Assume you want to buy yourself Lamborghini Huracan in 10 years. Assume further that in 10 years, Lamborghini Huracan will cost S500,000. Assume interest rate is 12% compounded monthly a) How much lump sum do you need to deposit today to be able to buy the Lamborghini? Page 1 of 2 vords English (United States W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts