Question: I need help with scenario C of this problem. mulas Data Review Page Layou Home Insert Draw 14 IB Calibri (Body) Paste BI U AVE

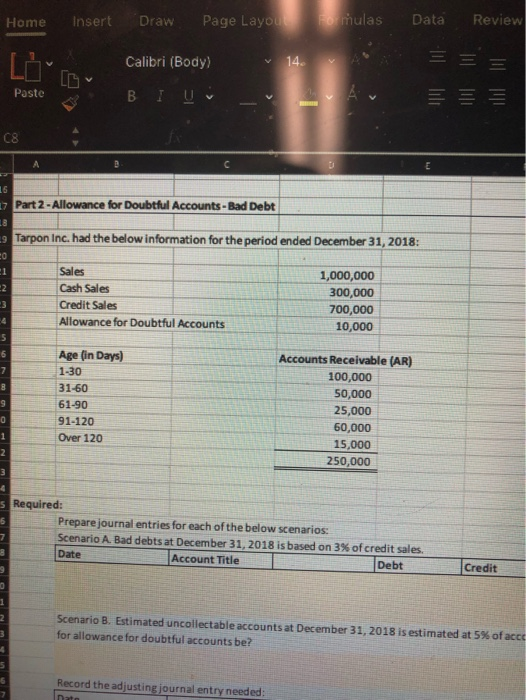

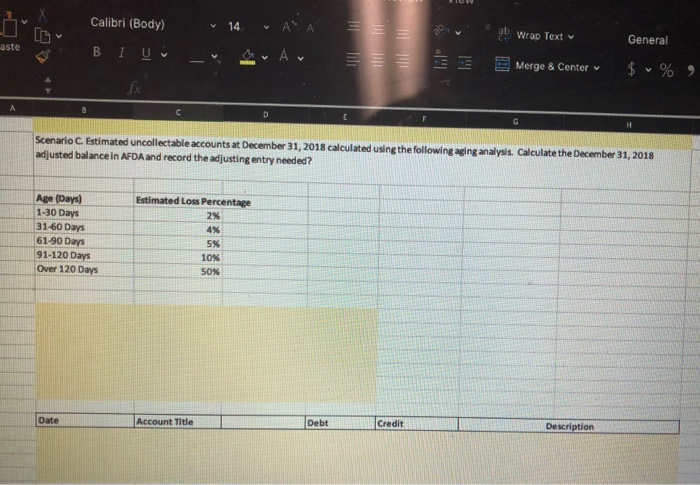

mulas Data Review Page Layou Home Insert Draw 14 IB Calibri (Body) Paste BI U AVE Part 2 - Allowance for Doubtful Accounts - Bad Debt Tarpon Inc. had the below information for the period ended December 31, 2018: Sales Cash Sales Credit Sales Allowance for Doubtful Accounts 1,000,000 300,000 700,000 10,000 Age (in Days) 1-30 31-60 61-90 91-120 Over 120 Accounts Receivable (AR) 100,000 50,000 25,000 60,000 15,000 250,000 Required: Prepare journal entries for each of the below scenarios: Scenario A. Bad debts at December 31, 2018 is based on 3% of credit sales. Date Account Title Debt Credit Scenario B. Estimated uncollectable accounts at December 31, 2018 is estimated at 5% of ac for allowance for doubtful accounts be? Record the adjusting journal entry needed: Calibri (Body) 14 v a General A" A E A Wrap Text E Merge & Center w B $ % Scenario C. Estimated uncollectable accounts at December 31, 2018 calculated using the following aging analysis. Calculate the December 31, 2018 adjusted balance in AFDA and record the adjusting entry needed? Estimated Loss Percentage Age (Days) 1-30 Days 31-60 Days 61-90 Days 91-120 Days Over 120 Days 10N Date Account Title Debt Credit Description

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts