Question: I need help with the second part, I thought FASB section 740-20 45-7 was correct but it is not apparently, if someone can tell me

I need help with the second part, I thought FASB section 740-20 45-7 was correct but it is not apparently, if someone can tell me what the actual FASB codification is, I would be really grateful.

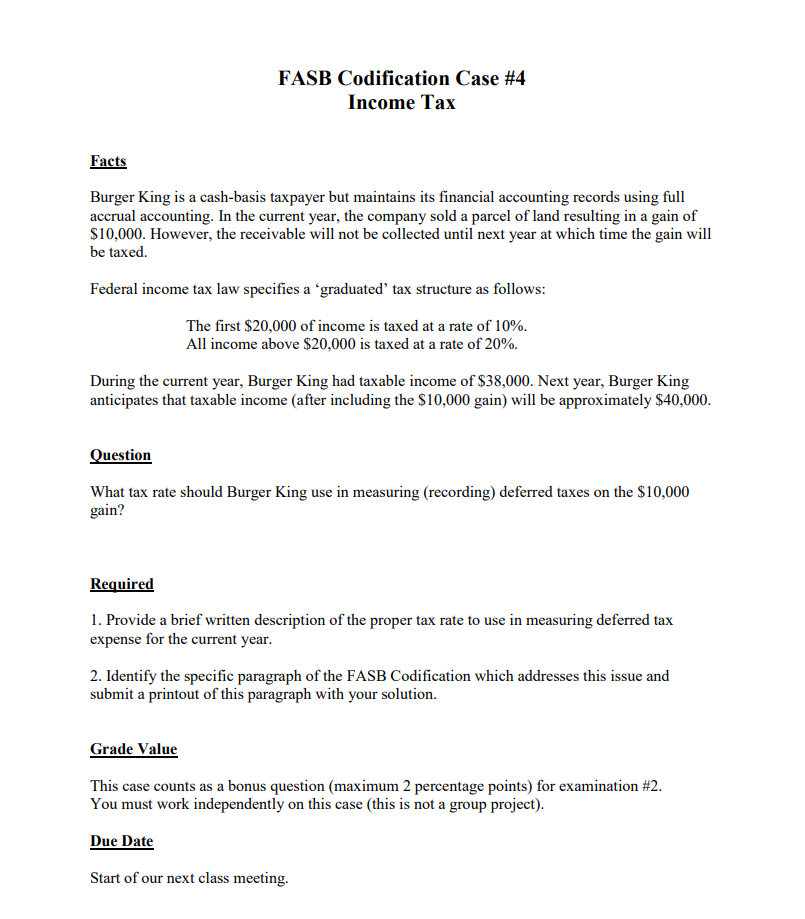

FASB Codification Case #4 Income Tax Facts Burger King is a cash-basis taxpayer but maintains its financial accounting records using full accrual accounting. In the current year, the company sold a parcel of land resulting in a gain of $10,000. However, the receivable will not be collected until next year at which time the gain will be taxed. Federal income tax law specifies a graduated' tax structure as follows: The first $20,000 of income is taxed at a rate of 10%. All income above $20,000 is taxed at a rate of 20%. During the current year, Burger King had taxable income of $38,000. Next year, Burger King anticipates that taxable income (after including the $10,000 gain) will be approximately $40,000. Question What tax rate should Burger King use in measuring (recording) deferred taxes on the $10,000 gain? Required 1. Provide a brief written description of the proper tax rate to use in measuring deferred tax expense for the current year. 2. Identify the specific paragraph of the FASB Codification which addresses this issue and submit a printout of this paragraph with your solution. Grade Value This case counts as a bonus question (maximum 2 percentage points) for examination #2. You must work independently on this case (this is not a group project). Due Date Start of our next class meeting. FASB Codification Case #4 Income Tax Facts Burger King is a cash-basis taxpayer but maintains its financial accounting records using full accrual accounting. In the current year, the company sold a parcel of land resulting in a gain of $10,000. However, the receivable will not be collected until next year at which time the gain will be taxed. Federal income tax law specifies a graduated' tax structure as follows: The first $20,000 of income is taxed at a rate of 10%. All income above $20,000 is taxed at a rate of 20%. During the current year, Burger King had taxable income of $38,000. Next year, Burger King anticipates that taxable income (after including the $10,000 gain) will be approximately $40,000. Question What tax rate should Burger King use in measuring (recording) deferred taxes on the $10,000 gain? Required 1. Provide a brief written description of the proper tax rate to use in measuring deferred tax expense for the current year. 2. Identify the specific paragraph of the FASB Codification which addresses this issue and submit a printout of this paragraph with your solution. Grade Value This case counts as a bonus question (maximum 2 percentage points) for examination #2. You must work independently on this case (this is not a group project). Due Date Start of our next class meeting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts