Question: ***I really just need help with the income statement, statement of changes in retained earnings, and the balance sheet*** Make sure that your debits =

***I really just need help with the income statement, statement of changes in retained earnings, and the balance sheet***

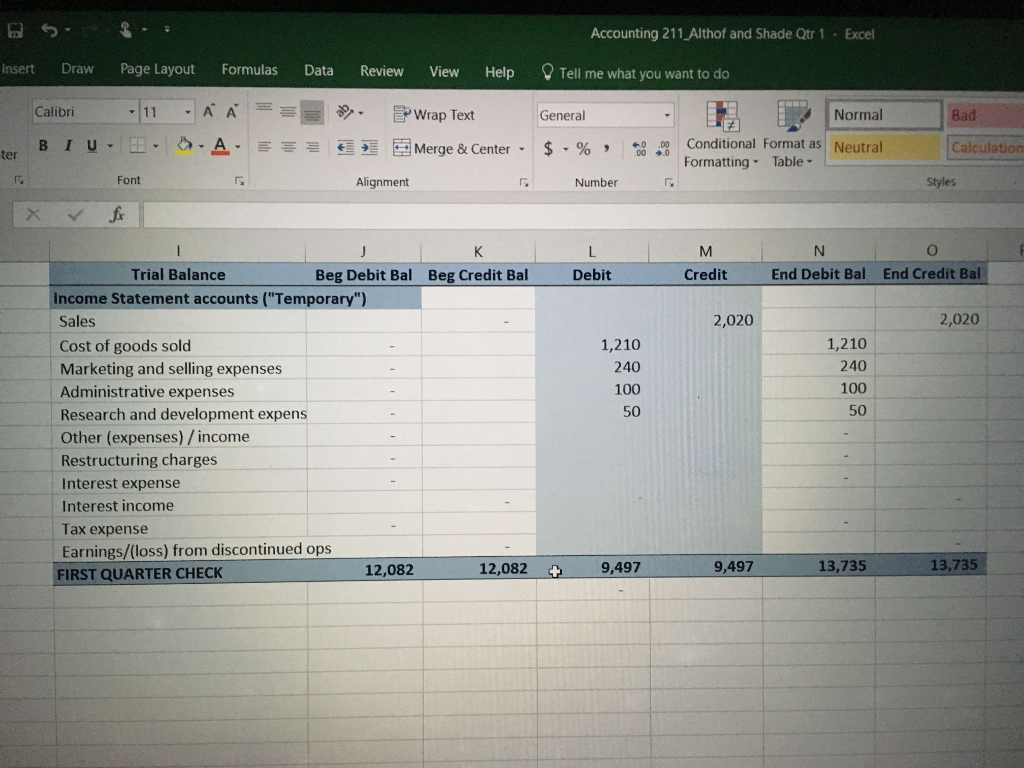

Make sure that your debits = credits at the bottom of the general journal entry columns. These columns should total: Qtr 1: 9,497.

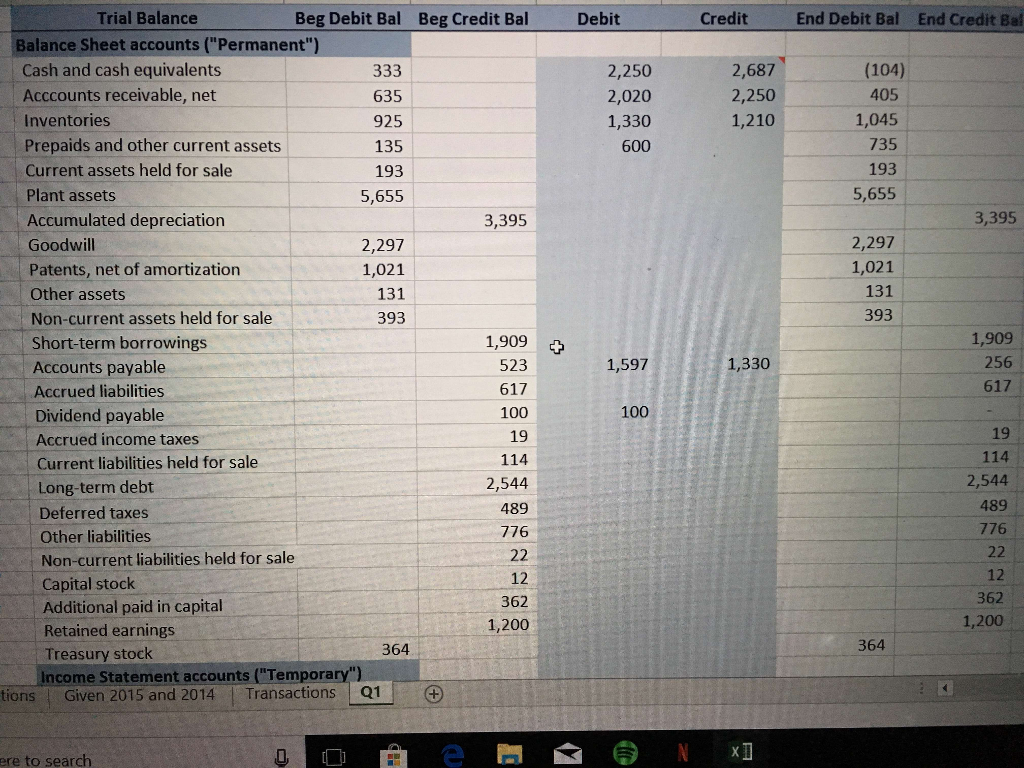

Post each transaction from the General Journal to the trial balance for the quarter. Notice that when you have a trial balance, the total debits will equal the total credits at the bottom of the columns. Your entries will be made in the shaded area, with debits in one column and credits in the other. The ending balance will then be the beginning balance, adjusted by the debit and credit entries that you made. The accounts with debit balances will be increased by debit entries and decreased by credit entries. The accounts with credit balances will be decreased by debit entries and increased by credit entries. Review the formulas provided in the first quarter to understand how these adjustments will impact the account balances. Make sure your trial balance balances by showing the debits = credits.

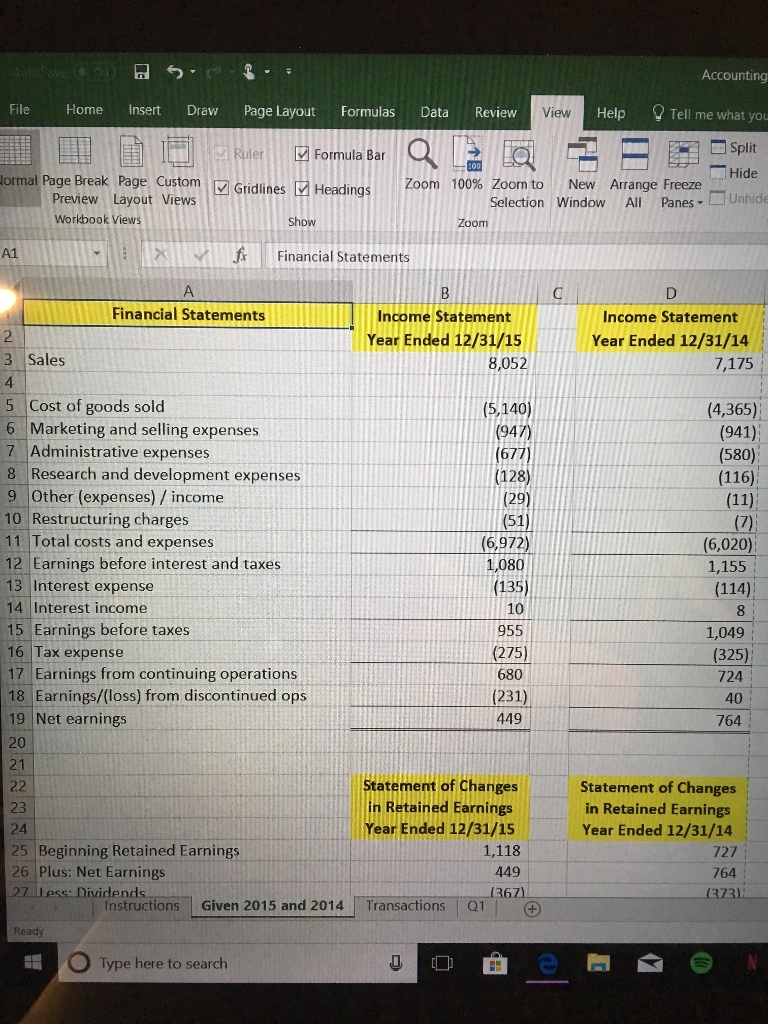

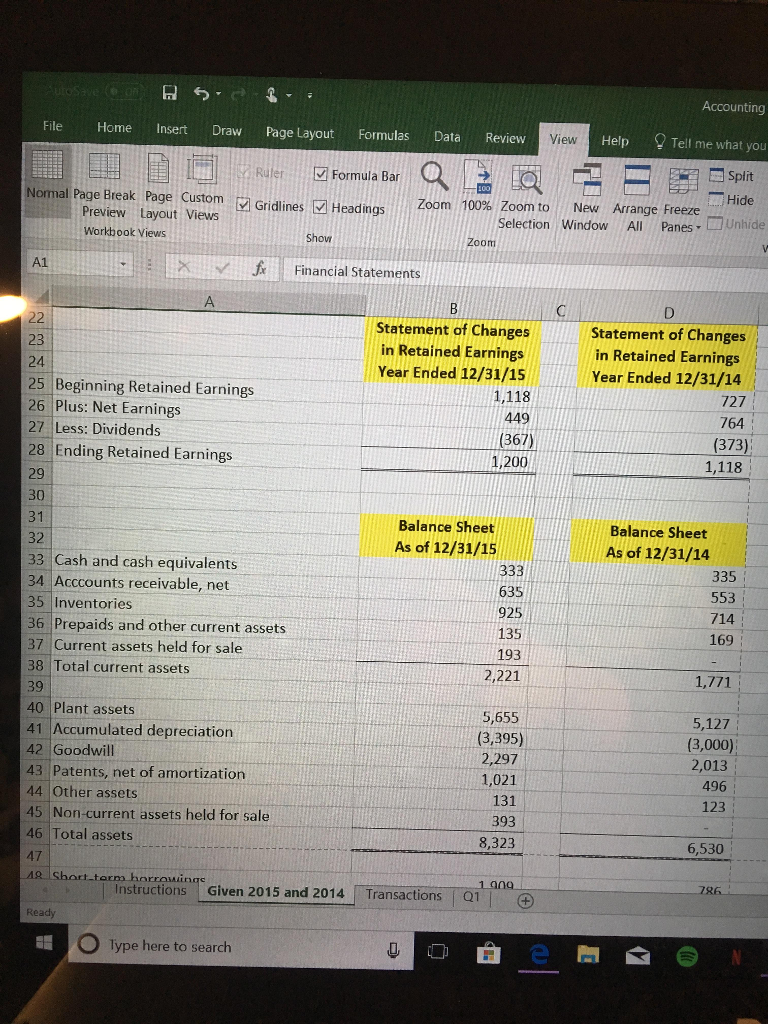

Prepare an income statement, statement of changes in retained earnings, and balance sheet. Review the formulas used to understand which accounts on the trial balance go to each line, and note how formulas were used to subtotal and total the various parts of the financial statements. To be consistent in our formatting, we will put items to be subtracted (expenses or dividends) in brackets to show they are being subtracted. Remember that the income statement and statement of changes in retained earnings are both statements that cover a period of time. The balance sheet is at a point in time. Therefore, to prepare an annual income statement or statement of changes in retained earnings, you will have to add each of the four quarters together to get a total. The balance sheet is the same whether you are talking about the end of the quarter or the end of the year-to-date, since the "as of" date is the same. Net income for each quarter is: Qtr 1: 420 AND Total Assts as of the end of the quarter is: Qtr1: 8,376

Transactions:

Beginning Notes:

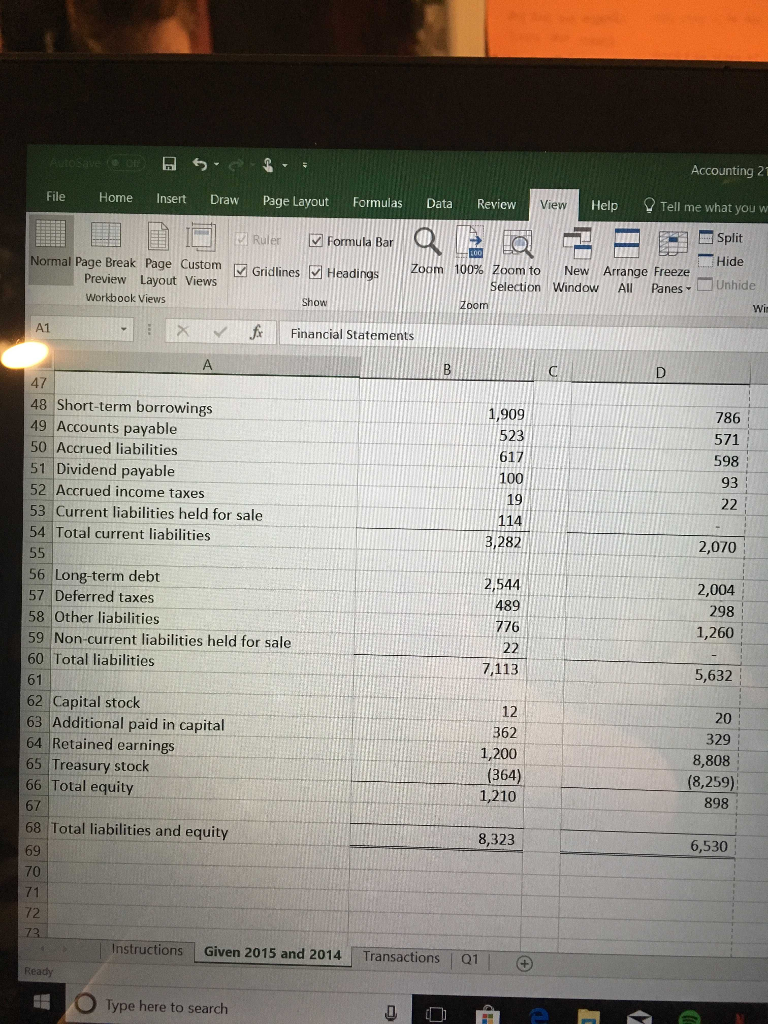

1) Two years of financial statements are provided for CS Company.

2) Use the account/financial statement line headings from the "Given 2015 and 2014" tab to prepare journal entries for the transactions below.

3) All sales are made on account.

4) We use the term "Administrative Expenses" as a category to cover many different types of expenses, including wages of office employees, insurance,

5) There is no general ledger account for Dividends. When dividends are declared, post them directly to Retained Earnings.

Events:

1/2/2016: CS Corporation collected $575 from customers that was in Accounts Receivable.

1/8/2016: Inventory was purchased for $360, on account.

1/31/2016: Record the total of January sales: Sales of $790 were made, and $500 worth of inventory was shipped out.

2/1/2016: An advertising campaign was launched and CS Company paid cash of $600. The advertising will cover five months of advertising (through June 30) and the expense should be spread evenly over that time.

2/2/2016: All Dividends Payable from prior year end were paid.

2/5/2016: CS Corporation collected $625 from customers that was in Accounts Receivable.

2/16/2016: Paid $600 of Accounts Payable.

2/20/2016: Inventory was purchased for $320, on account.

2/27/2016: CS Corporation collected $190 from customers that was in Accounts Receivable.

2/28/2016: Record the total of February sales: Sales of $860 were made, and $490 worth of inventory was shipped out.

3/3/2016: CS Corporation collected $860 from customers that was in Accounts Receivable.

3/6/2016: Inventory was purchased for $650, on account.

3/8/2016: Paid $380 of Accounts Payable.

3/17/2016: The research lab costs amounting to $50 were paid for the first quarter. These costs were not previously accrued.

3/18/2016: Paid all $617 of the Accrued Liabilities that had been accrued at the end of the prior quarter.

3/19/2016: $100 was paid for Administrative expenses.

3/21/2016: Record the adjustment to record the use of advertising expendenditures which were paid February 1.

3/31/2016: Record the total of March sales: Sales of $370 were made, and $220 worth of inventory was shipped out.

Given 2015 and 2014

Trial Balance Beg Debit Bal Beg Credit Bal Debit Credit End Debit Bal End Credit Bal Balance Sheet accounts ("Permanent") 2,687 2,250 1,210 2,250 2,020 1,330 600 (104) 405 1,045 735 193 5,655 Cash and cash equivalents Acccounts receivable, net Inventories Prepaids and other current assets Current assets held for sale Plant assets Accumulated depreciation Goodwill Patents, net of amortization Other assets Non-current assets held for sale Short-term borrowings Accounts payable Accrued liabilities Dividend payable Accrued income taxes 635 925 135 193 5,655 3,395 3,395 2,297 2,297 1,021 131 393 1,021 131 393 1,909 523 617 100 19 114 2,544 489 776 1,909 256 617 1,597 1,330 100 114 2,544 489 776 Current liabilities held for sale Long-term debt Deferred taxes Other liabilities Non-current liabilities held for sale Capital stock Additional paid in capital Retained earnings Treasury stock Income Statement accounts ("Tempora 362 1,200 362 1,200 364 364 tions ! Given 2015 and 2014 | Transactions | Q1 | ere to search Trial Balance Beg Debit Bal Beg Credit Bal Debit Credit End Debit Bal End Credit Bal Balance Sheet accounts ("Permanent") 2,687 2,250 1,210 2,250 2,020 1,330 600 (104) 405 1,045 735 193 5,655 Cash and cash equivalents Acccounts receivable, net Inventories Prepaids and other current assets Current assets held for sale Plant assets Accumulated depreciation Goodwill Patents, net of amortization Other assets Non-current assets held for sale Short-term borrowings Accounts payable Accrued liabilities Dividend payable Accrued income taxes 635 925 135 193 5,655 3,395 3,395 2,297 2,297 1,021 131 393 1,021 131 393 1,909 523 617 100 19 114 2,544 489 776 1,909 256 617 1,597 1,330 100 114 2,544 489 776 Current liabilities held for sale Long-term debt Deferred taxes Other liabilities Non-current liabilities held for sale Capital stock Additional paid in capital Retained earnings Treasury stock Income Statement accounts ("Tempora 362 1,200 362 1,200 364 364 tions ! Given 2015 and 2014 | Transactions | Q1 | ere to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts