Question: I think the labels in the left column are correct but i could be wrong. GR Toys wanted 2017 with no inventories. During the year,

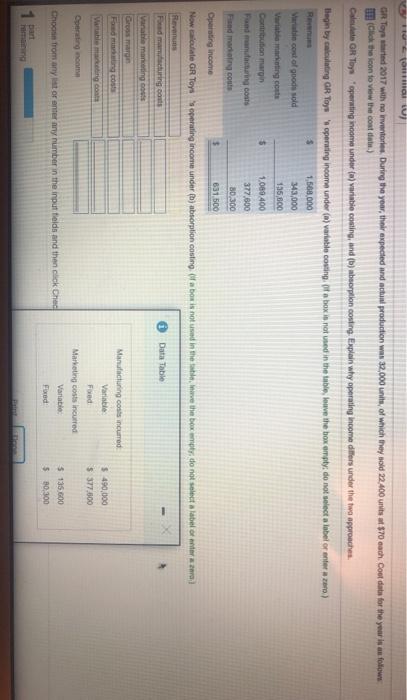

GR Toys wanted 2017 with no inventories. During the year, their expected and actual production was 32,000 units, of which they sold 22.400 units of $70 each. Coot data for the year is as follow (Click the foon to view the cost C OR Toys operating income under (m) variatie costing, and (b) boorption conting. Explain why operating income differs under the two approaches llegin by calculating GR Toye operating income under variabile contingita box is not uned in the table bave the box empty, do not select a label or enter a zena) RE 5 1,568,000 Variable cost of goods sold 343,000 Varaming costs 135,000 Contribution margin $ 1,080.400 Fondatang costs 377,800 80,300 and madong cout $ 631,500 Operating income Now sole GR Toys operating income under b) absorption costing of a box is not used in the save the box empty do not select a labelor Data Table Fed mamacuring costs Want mancing Gross marge Feeding costs Manufacturing costs incurred Variable Fored Marketing costs incurred Variable $ 490,000 $ 377.800 Opening om Choose from any or enter any number in the input fields and then click Chad $ 135,600 $ 30,300 Food 1 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts