Question: I WILL LIKE ASAP - Can you please help me answer this by showing your working out process, no excel or financial calculators I would

I WILL LIKE ASAP - Can you please help me answer this by showing your working out process, no excel or financial calculators I would like to see the calculations and equations used for the answers

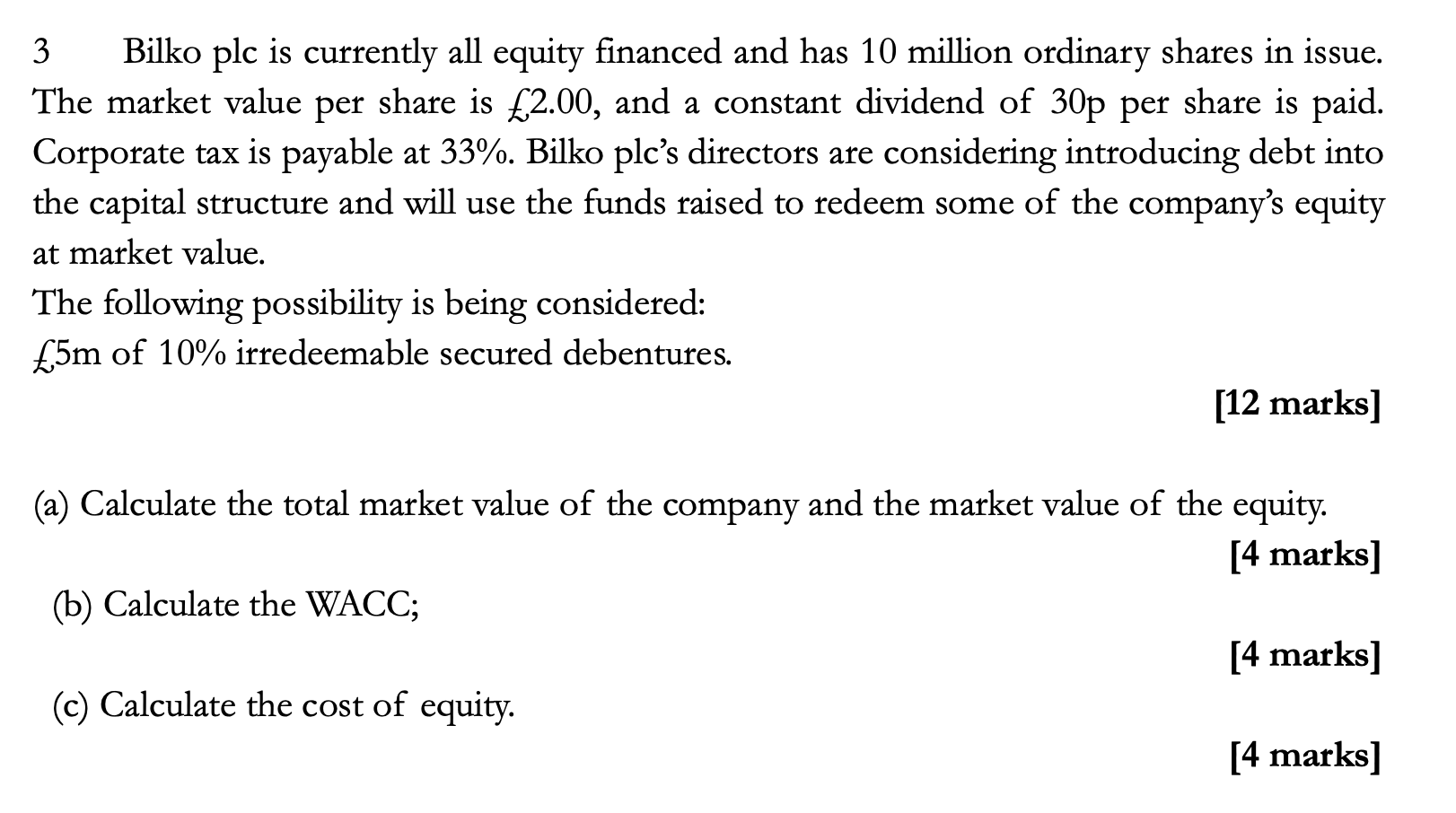

3 Bilko plc is currently all equity financed and has 10 million ordinary shares in issue. The market value per share is 2.00, and a constant dividend of 30p per share is paid. Corporate tax is payable at 33%. Bilko plc's directors are considering introducing debt into the capital structure and will use the funds raised to redeem some of the company's equity at market value. The following possibility is being considered: 5m of 10% irredeemable secured debentures. [12 marks] (a) Calculate the total market value of the company and the market value of the equity. [4 marks] (b) Calculate the WACC; [4 marks] (c) Calculate the cost of equity. [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts