Question: If you could explain how you solved for it, I would appreciate it. Determining Bond Features and Selling Price On January 1 of Year 1,

If you could explain how you solved for it, I would appreciate it.

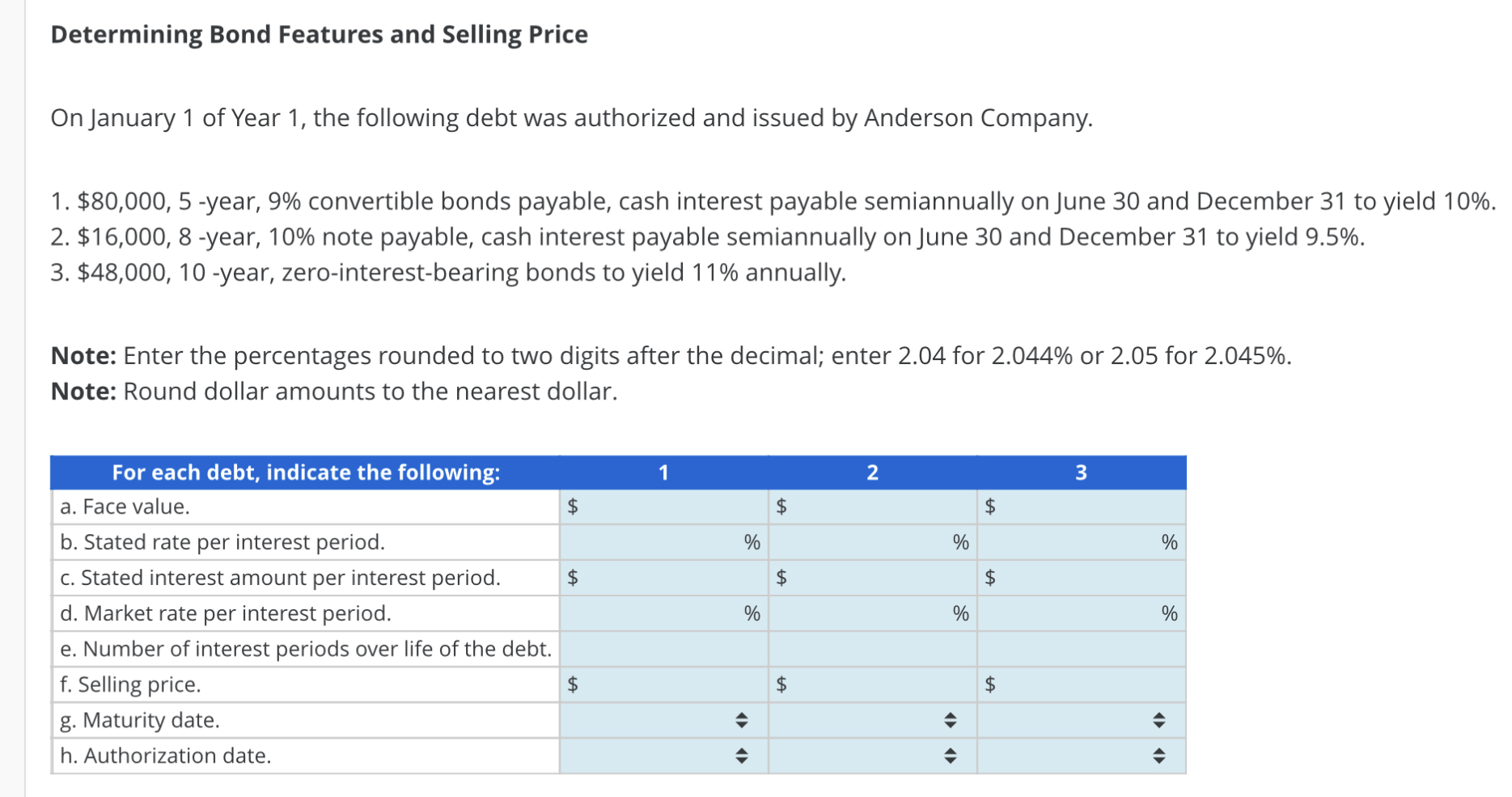

Determining Bond Features and Selling Price On January 1 of Year 1, the following debt was authorized and issued by Anderson Company. 1. $80,000,5-year, 9% convertible bonds payable, cash interest payable semiannually on June 30 and December 31 to yield 10%. 2. $16,000,8-year, 10% note payable, cash interest payable semiannually on June 30 and December 31 to yield 9.5%. 3. $48,000,10-year, zero-interest-bearing bonds to yield 11% annually. Note: Enter the percentages rounded to two digits after the decimal; enter 2.04 for 2.044% or 2.05 for 2.045%. Note: Round dollar amounts to the nearest dollar. Determining Bond Features and Selling Price On January 1 of Year 1, the following debt was authorized and issued by Anderson Company. 1. $80,000,5-year, 9% convertible bonds payable, cash interest payable semiannually on June 30 and December 31 to yield 10%. 2. $16,000,8-year, 10% note payable, cash interest payable semiannually on June 30 and December 31 to yield 9.5%. 3. $48,000,10-year, zero-interest-bearing bonds to yield 11% annually. Note: Enter the percentages rounded to two digits after the decimal; enter 2.04 for 2.044% or 2.05 for 2.045%. Note: Round dollar amounts to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

To determine the bond features and selling price for each debt instrument we follow these steps 1 Co... View full answer

Get step-by-step solutions from verified subject matter experts