Question: Ignore the answer there and show me an explained answer 2) (7 pts) Assume the following information: U.S. deposit rate for 1 year 2.2% U.S.

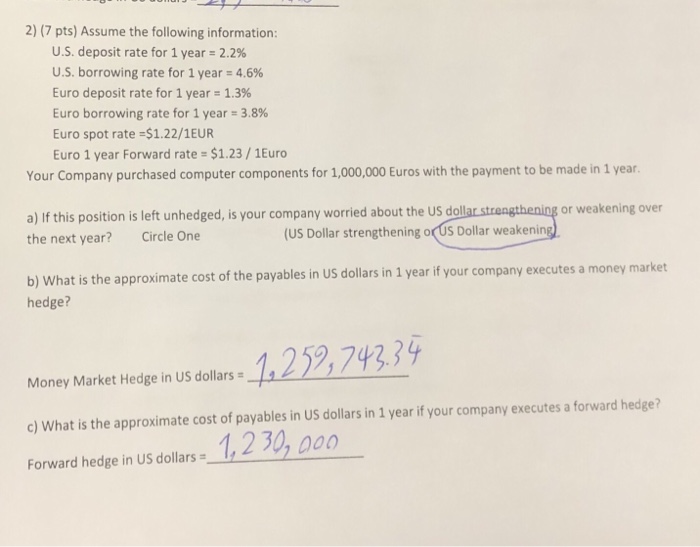

2) (7 pts) Assume the following information: U.S. deposit rate for 1 year 2.2% U.S. borrowing rate for 1 year : 4.6% Euro deposit rate for 1 years 1.3% Euro borrowing rate for 1 year 38% Euro spot rate $1.22/1EUR Euro 1 year Forward rate $1.23/1Euro Your Company purchased computer components for 1,000,000 Euros with the payment to be made in 1 year a) If this position is left unhedged, is your company worried about the US doll the next year? Circle One or weakening over (US Dollar strengthening oUs Dollar weakening at is the approximate cost of the payables in US dollars in 1 year if your company executes a money market b) Wh hedge? ere 1.22 74237 Money Market Hedge in US dollars c) What is the approximate cost of payables in US dollars in 1 year if your company executes a forward hedge? Forward hedge in US dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts